Same Work, Half the Time: Why You Should Invest in an Accounting Operations Role

.png)

Picture this: your accounting team’s workflows are humming. Your month-end close is done on time, every month. The team produces accurate, comprehensive reports for leadership.

So what’s missing from this scene?

The answer is opportunity. Traditional accounting processes are built around static systems, manual workflows, and backwards-looking reporting.Forward-thinking companies today are increasingly seeking to integrate these processes into something greater than the sum of its parts.

To seize this opportunity, many of them are setting up a dedicated Accounting Operations function. One such company is Public.com, where Steve Nolan built accounting operations from the ground up. Steve recently sat down with Tierny Pretzer from Numeric to share his experience setting up this new function and growing its impact.

Here’s what Steve taught us about the opportunity, along with his advice for executing in a scaling environment.

Want to watch our full webinar, The Fundamentals of Accounting Operations: How Public.com Approaches Accounting with Impact with Steve Nolan? If yes, check it out below!

What Is Accounting Operations?

The purpose of accounting operations is to align your accounting team and their workflows with your organization’s goals. But what does that mean in practice?

According to Steve, accounting operations involves:

- Looking for and creating efficiencies

- Providing the team with best-in-class tools

- Ensuring the team collaborates effectively

- Managing treasury and procurement needs

- Evaluating potential A.I. implementations

These are just a few examples; part of Steve’s job is also to proactively look for new ways that the accounting team can add value across other departments.

But when Steve first established accounting operations at Public.com, one of his priorities was to bring procurement in-house. Initially, this involved creating a Google survey for teams across Public.com to use when evaluating vendors — something that would give the accounting team a clear view of contracts and procurement needs. While accurate, the survey process was highly manual. To solve this issue, Steve partnered with a new vendor to implement the survey data and manage the entire procurement process using a single platform.

18 months later, Steve considers this procurement workflow to be one of the strongest in the entire finance department.

This example not only highlights the opportunity presented by accounting operations, but the need for advocacy and proactive long-term thinking. If Steve hadn’t taken ownership of procurement and lobbied for a better workflow, it’s possible Public.com would still be spending hours each month filling out and troubleshooting the Google survey.

Significant organizational changes require collaboration and trust across departments, which Steve recognizes takes time. With every win, however, the benefits of the accounting operations function become more apparent, opening the door to further partnership.

Accounting as a strategic function

Within many companies, accountants are still treated as number crunchers. Accounting operations seeks to overcome this attitude by transforming accountants from numbers people into business people.

As accountants look to move beyond the stereotype of menial number crunchers to true business analysts, accounting operations is one area where they can reflect their business acumen.

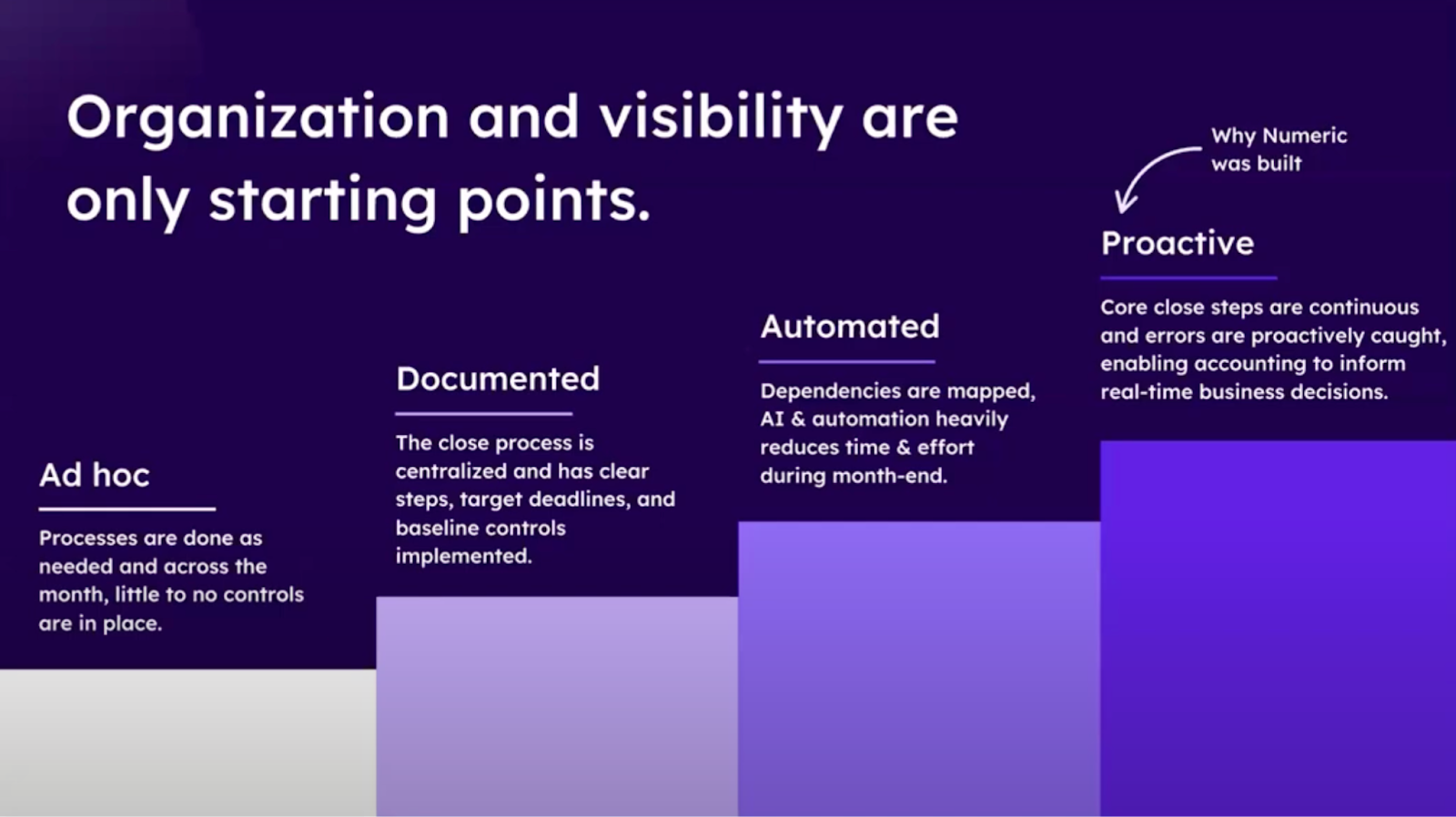

This transformation is most effective when it leverages innovation (albeit gradually and with a clear understanding of ROI). Steve Nolan suggests a four-stage maturity model to help accounting teams understand where they are and what a more strategic role might look like:

- Ad Hoc – Scrambling to gather data

- Documented – Consistent, repeatable workflows

- Automated – Systems handle repetitive tasks, with human oversight

- Proactive – Accounting generates insights and flags risk before it surfaces

To progress through the maturity model, the accounting operations function needs to see the 30,000-foot view and provide an honest evaluation of where inefficiencies exist. Then, the right tools can be put in place to alleviate said inefficiencies

For instance: Public.com used Numeric to move from stage two to stage four. By automating reconciliations, creating structured workflows, and standardizing close processes with an emphasis on speed, the accounting team reduced time spent on manual tasks and positioned themselves to do more strategic work — like helping the product team understand margin impacts, or identifying vendor billing issues before they become a problem.

Steve’s aim in progressing through the maturity models was to help Public.com’s accounting team move from “what are the numbers” to “why are the numbers”. This shift would more closely embed the accounting function within Public’s company-wide decision-making processes, while still preserving data accuracy and improving the speed of the team’s workflows.

Continuous improvement = considerable impact

Sometimes, the biggest opportunity for any team is simply to do what you’re already doing, but faster.

What better role to lead the charge than accounting operations? Take the example of Public.com’s internal reporting timing, and what Steve did to bring about a game-changing improvement:

Previously, the team’s process was to finalize adjusted burn and adjusted EBITDA figures by BD 8. Steve pushed for changes across Public.com’s tech stack, including partnering with new vendors like Numeric, Apprentice, and BRM. Today, the team delivers the same data by BD 3 — a five business day improvement!

“To anyone in accounting, they understand the importance of five days. BD 8, with weekends, might be the middle of the month. So you’re able to get your leadership team vital information three days into the month, that they can then use to make agile decisions for the organization.” – Steve Nolan

Getting from BD 8 to BD 3 required structured workflow reviews. Following each month-end close, Steve would meet with the team to evaluate their major workflows and assign one of three statuses to each (as part of a Gantt chart to help visualize how long each workflow takes):

🔴 Red – Areas for improvement

🔵 Blue – Stable and functioning as expected

🟢 Green – Recently improved

This framework gave the team a shared language to track progress, resolve inefficiencies, and make continuous improvements to their workflows. With every small win, the overall month-end close process got better and better until the team attained their current BD 3 turnaround time — unquestionably a big win for Public.com as a company.

Automation and A.I.: real benefits, real limitations

Automation and A.I. implementation are often regarded as end goals in themselves. Steve offers a more balanced view: these technologies extend team capacity, but don’t replace it. While his team always looks to automate and be agile, they are also cognizant of reaching capacity and the potential need to grow headcount.

As an example, Public.com’s accounting team uses a combination of Excel macros, Python scripts, and built-in automation features in Numeric to eliminate repetitive work.

Furthermore, using Numeric as a centralized hub to document their processes allowed Public.com to experiment with A.I. tools like ChatGPT. Handling some processes with the help of A.I. has saved time and created significant leverage for Steve’s team.

But Steve also unpacked some of A.I.’s current limitations for accounting:

- A.I. doesn’t immediately understand business context

- A.I. isn’t ready for regulatory reporting or external audits

- Custom tech stacks often require human judgment and creative problem-solving

- Improperly implemented tools can reinforce silos instead of solving them

As a broker-dealer, Public.com is subject to specific SEC and FINRA regulations, meaning that a significant portion of their workflows related to those regulations can’t be automated just yet. Nevertheless, the company’s accounting operations function is well-positioned to monitor emerging opportunities to leverage A.I. and automation.

Why Companies Are Investing in Accounting Operations

The benefits of accounting operations are clear. The function is becoming an increasingly important differentiator for companies like Public.com, where accounting operations has unlocked:

- Faster close cycles without compromising control

- More automation that actually fits the business

- Tighter collaboration with IT, product, and FP&A

- Stronger audit readiness and internal visibility

- Less manual work and happier team members

These are not abstract or far-flung outcomes. They’re the result of team alignment, strategic planning, concrete improvements to workflows, and use of platforms like Numeric that support visibility, consistency, and accountability.

In any company, finance teams shouldn’t have to rely on spreadsheets and tribal knowledge. Accounting operations gives teams the structure they need to meet deadlines, deliver insights, and support the business in real time.

Final Thoughts

Modern accounting is smarter, more collaborative, and scalable by design. Accounting operations makes this a reality by giving accountants the tools to move from data prep to decision support. Accounting operations also creates the structure needed for automation to actually work, and it upgrades the month-end close process from an ad hoc process into a valuable source of insights.

Public.com’s journey shows what’s possible. With the right supporting function in place and the right tools in hand, accounting can become a force multiplier for the business.

As Steve put it, accounting operations is the track the train runs on. Once it’s in place, the whole company moves faster.

.png)