Best AI Accounting Software: 2026’s Top Tools for Finance

.webp)

It’s no secret that today’s accounting teams are drowning in climbing transaction volumes, growing internal expectations, and rising business complexity. If late-at-night spreadsheet wrestling is keeping you from making good on your promise to bring strategic insights to your CFO, you’re far from alone.

The good news? Recent advancements in AI are working to make accounting workflows genuinely smarter. But with hundreds of tools claiming to be "AI-powered," how do you separate the game-changers from the glorified calculators?

In this guide, we've evaluated and ranked the 14 best AI accounting tools for finance teams in 2025. More importantly, we'll show you exactly where each tool adds the most value in your accounting workflow since the right AI solution depends entirely on where your biggest pain points live.

The best way to understand how accounting AI software works and can empower your team is to see it in action. Schedule a personalized demo to learn how Numeric can enhance your reconciliation and close management.

Table of Contents

- Key Takeaways: The 3 Best AI Accounting Software Tools

- What Actually Counts as AI Accounting Software?

- The Top 14 AI Accounting Software Tools for 2025

- Who Really Benefits from AI Accounting Software?

- How to Choose the Right AI Accounting Software for Your Team

- Common Pitfalls to Avoid When Implementing AI

- FAQs About AI Accounting Software

Key Takeaways: The 3 Best AI Accounting Software Tools

The best AI accounting software depends on your team's specific pain points and workflow needs. Here are our top picks based on different criteria:

- Numeric: Best overall AI accounting software for mid-sized to enterprise teams, with advanced AI features for reconciliation, variance analysis, and close management, plus the deepest ERP integrations in the market.

- Trullion: Ideal for teams prioritizing AI-powered lease accounting and revenue recognition, particularly effective for complex ASC 842 compliance and audit preparation.

- Ramp: Perfect for teams focused on accounts payable automation and spend management, offering robust AI-powered invoice processing and approval workflows.

By focusing on where AI delivers the most value for your specific accounting workflows, you'll make a choice that transforms manual processes into intelligent, automated systems that actually enhance your team's capabilities.

What Actually Counts as AI Accounting Software?

AI software for accounting refers to tech-based tools that use artificial intelligence (hence the name) to improve, optimize, and automate financial processes and accounting workflows. While traditional automation has been empowering accounting professionals for over a decade, the introduction of AI in accounting software is relatively new.

Importantly, there are major differences between the two concepts. In specific, standard accounting automation software uses predefined, rules-based scripts, which means that you can expect the same results over time. Meanwhile, AI-based apps learn continuously from historical data and user behavior to make smarter decisions adapted to past trends and new needs.

AI capabilities vary significantly across different tools. Some provide basic pattern recognition (barely better than traditional automation), while others offer sophisticated predictive analytics and intelligent decision-making. The most effective AI accounting tools focus on specific areas where machine learning delivers genuine value:

- Data Capture & Recognition: OCR technology that actually understands invoice formats and extracts the right information, even from poorly scanned documents

- Transaction Categorization: Smart coding that learns your company's unique expense patterns and vendor relationships

- Reconciliation Intelligence: Automated matching that goes beyond exact amounts to identify probable matches based on timing, patterns, and historical behavior

- Predictive Close Management: AI that forecasts potential bottlenecks in your close process based on past cycles and current workload

- Variance Analysis: Tools that automatically identify significant changes and draft preliminary explanations for flux analysis

- Anomaly Detection: Systems that flag unusual transactions or patterns that might indicate errors or require investigation

To gain insights into how exactly AI applies to accounting workflows and be better equipped to evaluate available tools, check out our comprehensive AI guide for accountants.

Who Benefits from AI Accounting Software?

To learn how real accounting teams are implementing AI and what their experiences have been, check out Incoming Statements Ep.2 featuring Jason Pikoos of Connor Group.

Let's be honest about fit. AI accounting software delivers the most value when you have:

- Complexity that outpaces your team size: You're a Controller managing the books for a 200-person company with just two other accountants.

- High transaction volumes: If you're manually reviewing hundreds of transactions monthly, AI can reclaim hours of your team's time.

- Multi-entity operations: Managing subsidiaries, multiple currencies, or various compliance standards where pattern recognition becomes invaluable.

- Scaling challenges: Your business is growing faster than you can hire accounting talent, and you need intelligent automation to bridge the gap.

The companies that see the biggest operational impact typically include:

- Growth-stage companies (Series B to pre-IPO) where accounting complexity is expanding faster than headcount

- Multi-entity businesses managing subsidiaries, international operations, or complex organizational structures

- High-volume transaction companies in industries like fintech, marketplace, or SaaS where manual processing becomes impossible

- Accounting firms serving multiple clients who need to scale efficiently without compromising accuracy

Here's where AI makes the biggest difference in day-to-day operations:

- Eliminating manual data entry errors that create reconciliation nightmares down the line

- Accelerating month-end close cycles by automating routine tasks and flagging exceptions early

- Providing real-time visibility into financial performance without manual report compilation

- Scaling processes consistently across different entities, currencies, or business units

If your team is still managing complex accounting workflows in spreadsheets – or if your current software requires constant manual intervention – AI-powered solutions can fundamentally change how efficiently you operate.

The tools you need in your 2026 tech stack

Top AI Accounting Software for 2025

Based on extensive research and evaluation of dozens of AI-powered accounting software, we ranked the 14 best software tools for each segment of the accounting workflow.

Following is a quick overview of the top AI software tools for those in the accounting industry and their main features:

1. Numeric

Numeric is the most comprehensive AI-powered close management platform designed specifically for accounting teams managing complex month-end processes. Unlike generic automation tools, Numeric combines advanced AI with purpose-built workflows for Controllers and accounting managers.

Numeric AI Capabilities

- AI-powered flux analysis: Automatically generates draft variance explanations by analyzing GL data, account trends, and historical performance patterns

- Technical accounting AI: Numeric’s technical accounting AI gives you GAAP-ready policy generation with links to public company filings and practical implementation guidance

- Predictive reconciliation alerts: Here, AI identifies potential reconciliation issues before they impact your close timeline

Numeric Pricing

Users can choose from three Numeric subscription plans:

- Starter: Suitable for teams looking to organize financial close and improve visibility. The AI technical accounting assistant is included. Pricing starts at $30/month/user.

- Growth: Best for teams looking to streamline and automate financial close, usually on QuickBooks or Xero. AI-parsing of bank statements for reconciliation is included. Pricing is custom.

- Enterprise: Ideal for teams looking for a continuously well-controlled close process on mature ERPs, such as NetSuite. Pricing is custom.

Numeric Pros

- Ahead-of-the-curve implementation of AI

- Intuitive interface that empowers rather than overwhelms

- Deep ERP integrations, including transaction-level details

- Unlimited scalability

Numeric Cons

- Fewer ERP integrations than some competitors

- Typical learning curve associated with implementing a new software system

Best For

- Teams and enterprises of all sizes looking for true AI leverage to optimize financial management

2. Trullion

Purpose-built for complex accounting standards, Trullion uses AI to automate lease accounting, revenue recognition, and audit workflows. Particularly strong for companies dealing with ASC 842, ASC 606, and other complex compliance requirements.

Trullion AI Capabilities

- Document intelligence: Extracts critical data from lease agreements, contracts, and financial documents with high accuracy

- Automated compliance calculations: AI ensures proper treatment under complex accounting standards

- Audit workflow automation: Streamlines audit preparation with intelligent document organization and analysis

Trullion Pricing

As reported on GetApp, Trullion pricing starts at $3,000/year.

Trullion Pros

- Strong audit efficiency

- Comprehensive standards compliance

- Good reporting capabilities

Trullion Cons

- Need to navigate multiple systems as Trullion supplements rather than replaces existing accounting tools

- Unclear pricing information

Best For

- Mid- to large-size businesses especially looking for lease accounting and revenue recognition AI solutions

3. Zeni

Zeni is a full-service AI bookkeeping platform that combines automated transaction processing with human oversight, designed for companies that want comprehensive bookkeeping support.

Zeni AI Capabilities

- Automated transaction categorization: AI learns your business model and categorizes transactions accordingly

- Real-time insights: Provides AI-generated analysis of financial performance and trends

- Receipt management: OCR technology extracts data from receipts and matches to transactions

- AI audit bot: Automates financial verification, error detection, and enforces GAAP compliance

Zeni Pricing

Zeni AI bookkeeping offers three plans. Pricing starts at $549/month, when billed annually.

Zeni Pros

- All-inclusive AI bookkeeping software capabilities

- Automated financial management

- Access to a dedicated finance team

Zeni Cons

- Limited functionalities beyond simple bookkeeping

- Expensive pricing, even for small teams

Best For

- Best AI accounting software for small businesses and startups that need support in reconciliations, bookkeeping, and financial reporting

4. Botkeeper

Designed specifically for accounting firms, Botkeeper uses AI to scale bookkeeping services across multiple clients efficiently.

Botkeeper AI Capabilities

- Smart Connect: Connects to clients’ accounts trouble-free for easier month-end close management

- Transaction Manager: Uses AI to automatically categorize and manage transactions

- Bot Review: Automatically surfaces discrepancies in real time.

Botkeeper Pricing

Botkeeper costs $69/month/license.

Botkeeper Pros

- Purpose-built for accounting firms

- Good AI-based automation

- Affordable pricing

Botkeeper Cons

- Limited standalone functionality (augmenting rather than replacing existing accounting tools)

- Limited application beyond accounting firms

Best For

- Accounting firms of different sizes

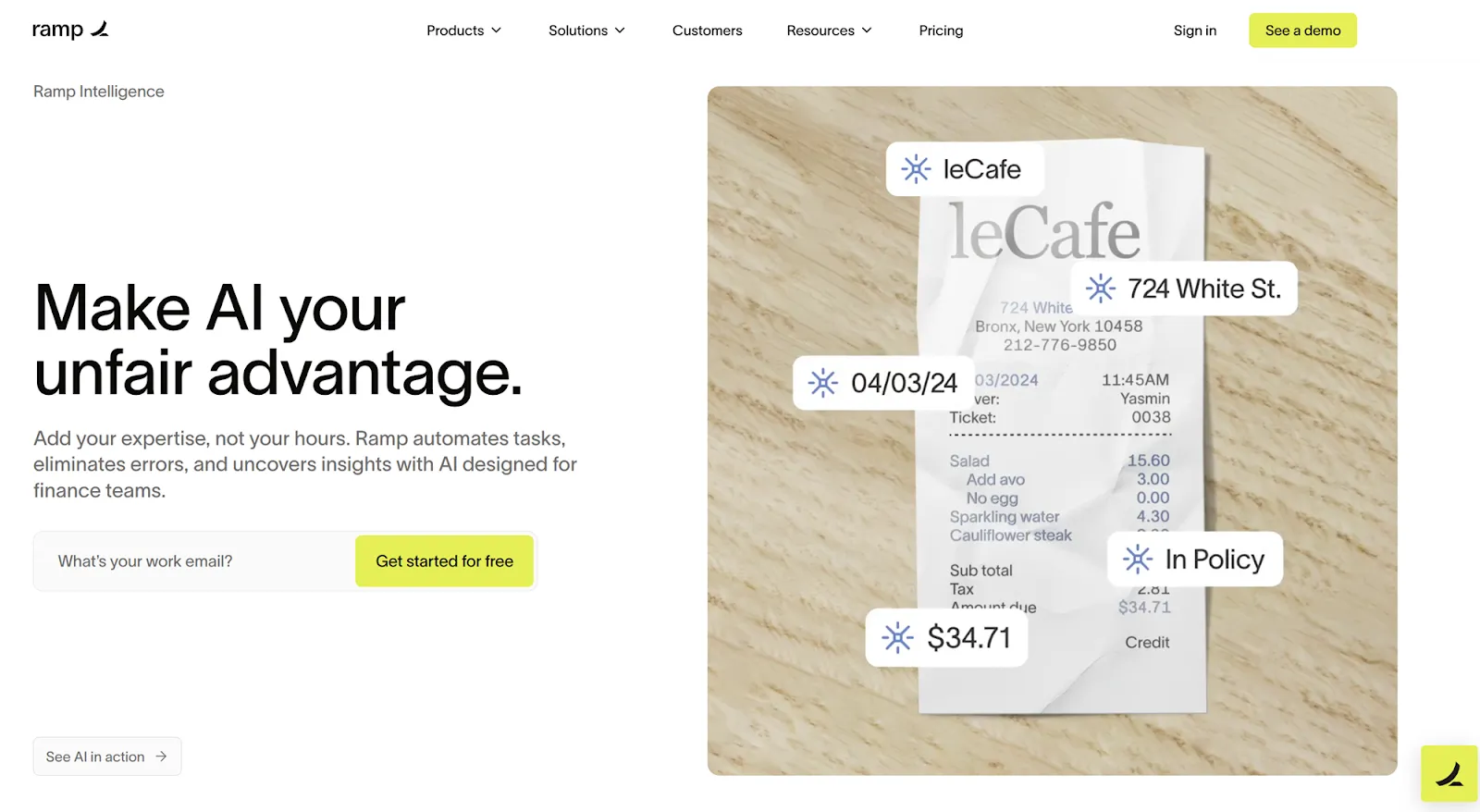

5. Ramp

Ramp leverages AI across the entire spend management lifecycle, from invoice processing to expense categorization to fraud detection. Particularly effective for companies wanting to eliminate manual AP work.

Ramp AI Capabilities

- Invoice management: Aids in processes bills, speeding up approvals, and commanding cashflow

- Smart approval flows: Makes it easy to build intelligent expense approval workflows and send alerts for errors or overbilling

- Expense management: Supports smart spend management in an effortless-manner

Ramp Pricing

Ramp has a free plan, making it a potentially good AI accounting software for small businesses in need of automating accounts payable. Paid plans start at $15/month/user.

Ramp Pros

- Thorough automation

- User-friendly features

- Flexible payment options

Ramp Cons

- Limited accounting functions beyond accounts payable

- Learning curve for more complex workflows

Best For

- Mid- and large-size enterprises looking to automate AP

6. Bill

Bill.com uses AI to streamline both accounts payable and receivable processes, with particularly strong automation for invoice management and payment processing.

Bill AI Capabilities

- Smart data extraction: Automatically captures invoice details with high accuracy, reducing manual data entry

- Intelligent approval routing: AI determines appropriate approval workflows based on transaction patterns

- Payment optimization: Suggests optimal payment timing and methods based on cash flow patterns

Bill Pricing

Bill Spend & Expense is free of charge. The pricing of Bill Accounts Payable & Receivable starts at $45/month/user.

Bill Pros

- Strong AP automation capabilities

- Audit-ready documentation

- Seamless integrations with the most popular ERPs

Bill Cons

- Limited customization

- Poor customer support (as reported in customer reviews)

Best For

- Small and medium businesses and accounting firms

7. Brex

Focused on global spend management, Brex uses AI to provide real-time expense tracking, automated compliance, and intelligent spend insights.

Brex AI Capabilities

- Real-time expense categorization: AI categorizes transactions as they occur, reducing month-end work

- Policy enforcement: Automatically flags transactions that violate company policies

- Global compliance: AI handles multi-currency transactions and international tax requirements

Brex Pricing

Brex offers a free plan for startups and growing teams. Paid subscriptions start at $12/month/user.

Brex Pros

- Global payment feasibility

- Real-time visibility

- Native integrations with multiple ERPs and other third-party tools

Brex Cons

- Limited procurement features

- Significant resources needed for implementation and initial setup

Best For

- Both small and large companies looking to optimize AP and spend management

8. Vic.ai

Vic.ai is an AI-first accounting software solution that automates AP with the help of machine learning. This helps finance teams reduce cost, increase accuracy, and scale faster and smarter.

Vic.ai AI Capabilities

- AI-first AP automation: Limits manual work and establishes more control with intelligent accounts payable automation.

- AI-powered expense management: Enforces company policies, removes manual tracking, and provides accounting teams with a unified view of all non-payroll corporate spend.

- AI-powered analytics: Offers real-time performance insights and supports smart actions for better operational outcomes.

Vic.ai Pricing

Vic.ai does not provide pricing information on the company website, while specifying that the cost depends on a number of factors including monthly number of invoices.

Vic.ai Pros

- High accuracy

- Scalability potential

- Easy integrations with ERPs and other tools

Vic.ai Cons

- Lack of pricing transparency

- Potentially steep learning curve, especially with more complex setups

Best For

- Larger enterprises looking to automate AP management involving large volumes of invoices

9. NetSuite

NetSuite is a popular ERP platform with a suite of financial management tools. The embedded AI functionality offers enhanced support to teams throughout their daily workflows. NetSuite integrates with Numeric in real time to facilitate account reconciliations.

NetSuite AI Capabilities

- Invoice processing: Uses AI-based document object detection and optical character recognition (OCR) technology to scan invoices

- Content generation: Uses generative AI to automate the creation and refinement of sales emails, purchase orders, and product descriptions

- Financial anomaly detection: Continuously scans financial data to identify and flag anomalies and recommend solutions.

- Analytics assistant: Retrieves information from SuiteAnalytics Workbooks for the creation of reports and charts.

NetSuite Pricing

The total cost of NetSuite is determined by the number of users and the required modules. It includes a one-time implementation fee and an annual subscription fee.

NetSuite Pros

- Comprehensive suite of accounting tools

- Global compliance

- Scalability

NetSuite Cons

- Complex customization

- Steep learning curve

- Unclear pricing range

Best For

- Mid- to large-scale enterprises with international operations

10. QuickBooks

Similar to NetSuite, QuickBooks is another software for accounting automation that leverages AI. It helps streamline financial processes and is most widely used by freelancers and small teams. QuickBooks integrates with Numeric to automate reconciliations.

QuickBooks AI Capabilities

- AI-powered invoicing: Creates, downloads, and sends personalized invoices

- Automated invoice reminders: Aids in reducing overdue payments and ensuring faster payments

- Expense categorization: Organizes expenses by category for accurate financial records and simplified tax preparation

QuickBooks Pricing

Pricing starts at $35/month and goes up with additional features.

QuickBooks Pros

- Powerful automation

- Strong integrations

- Free expert support

QuickBooks Cons

- Limited functionalities

- Limited customization options

- High cost for all features

Best For

- Small companies and freelancers looking for accounting automation

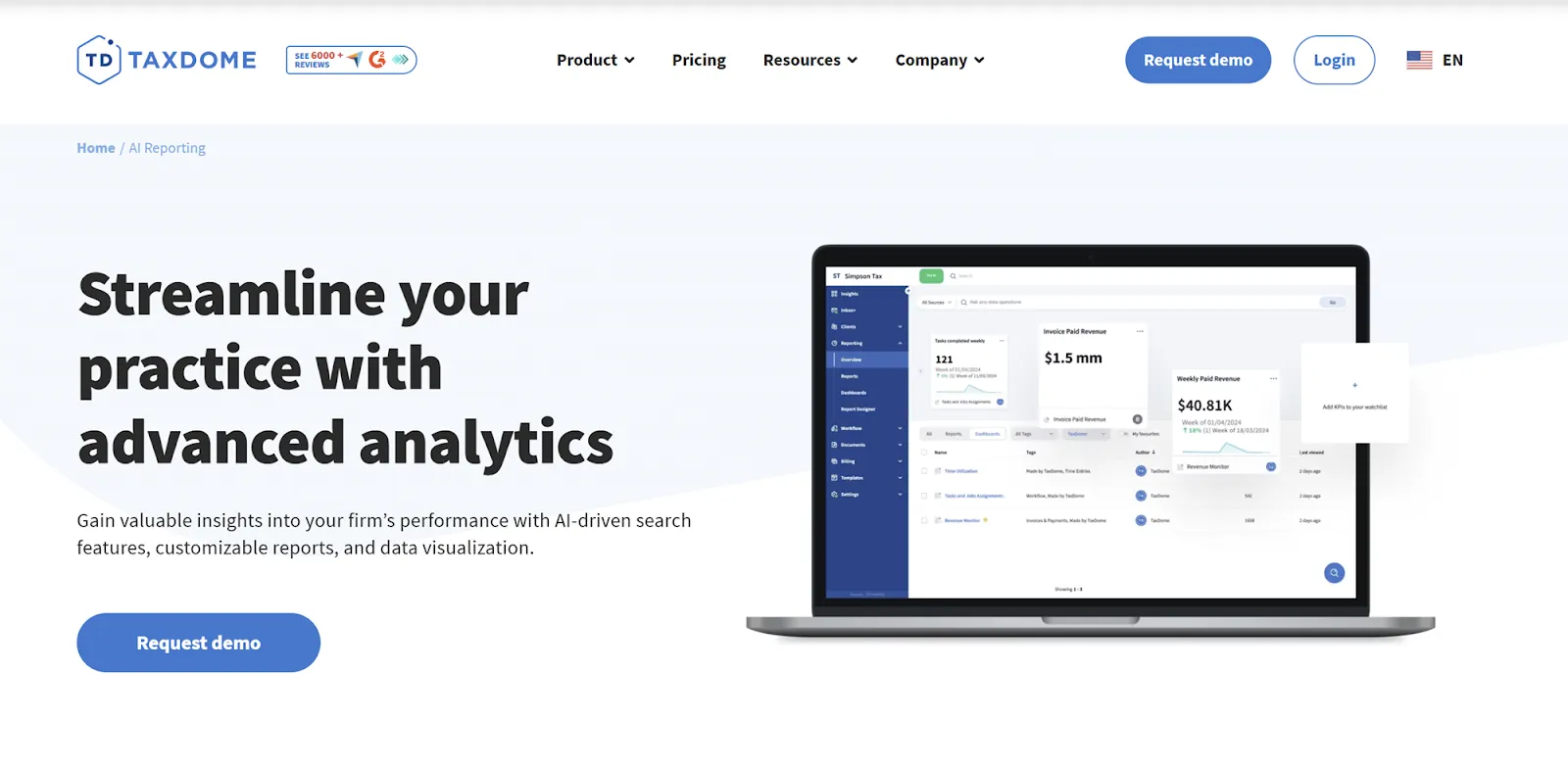

11. TaxDome

TaxDome is a practice management software that helps accountants, bookkeepers, and tax professionals manage clients accounting processes with emphasis on tax. The platform uses AI to automate repetitive tasks to help you get ready for tax season more quickly and efficiently.

TaxDome AI Capabilities

- AI-powered reporting: Provides insights into performance with AI search features, customizable reports, and data visualization.

- Automated document organization: Sorts and tags client documents based on content

- Performance insights: AI analyzes firm performance and identifies optimization opportunities

TaxDome Pricing

TaxDome pricing starts at $800/year/user and goes up with additional features.

TaxDome Pros

- Tailored to the needs of tax and accounting firms

- Enhanced client experience

- Good suite of features for tax purposes

TaxDome Cons

- Restricted customization options

- Limited features compared to other AI accounting software platforms

- Hefty price for freelancers and small firms

Best For

- Accounting and tax firms looking for AI-powered automation

12. Blue Dot

Blue Dot is a tax compliance and tax management software that relies on AI to improve processes. The platform specializes in the management of employee-driven transactions, decreasing the risk of vulnerabilities.

Blue Dot AI Capabilities

- VAT compliance automation: AI identifies and calculates VAT obligations across jurisdictions

- Employee benefits analysis: Automatically flags transactions subject to employee benefit taxation

- Multi-jurisdiction compliance: Handles complex international tax requirements

Blue Dot Pricing

The Blue Dot website does not provide pricing information.

Blue Dot Pros

- Excellent compliance

- Strong integrations

- Scalability

Blue Dot Cons

- Not a good fit for small companies

- Lack of transparent pricing

Best For

- Med- to large-scale enterprises

13. ChatGPT

Believe it or not, ChatGPT can be used for basic accounting tasks, such as data extraction, journal entry creation, policy writing, and spreadsheet formatting. Although this popular language model is not a dedicated AI accounting software, it can perform some of the most common tasks.

ChatGPT AI Capabilities

- Data analysis: Processes financial data to identify trends and anomalies

- Policy drafting: Generates accounting policy documentation

- Research assistance: Summarizes complex accounting standards and regulations

To maximize the value of ChatGPT to your business, try our list of ChatPGT prompts for accounting purposes.

ChatGPT Pricing

There is a free plan with basic features, while the complete version costs $20/month.

ChatGPT Pros

- Versatility that goes beyond purely accounting tasks

- Easy access at all times

- No learning curve

ChatGPT Cons

- Not a specialized financial management software

- High dependency on prompts

- Limited real-time data

Best For

- Small businesses and freelancers looking for a cost-efficient solution

14. Claude

Similar to ChatGPT, Claude is another AI learning model that can be used to help with accounting and financial tasks.

Claude AI Capabilities

- Financial analysis: Conducts sophisticated analysis of financial data and trends

- Report generation: Creates comprehensive financial reports and summaries

- Technical research: Analyzes complex accounting standards and provide implementation guidance

Claude Pricing

Pricing starts at $20/month/user.

Claude Pros

- Advanced logic and reasoning

- User-friendly interface

- Fully customizable workflows

Claude Cons

- Not a standalone accounting software

- Restricted real-time access to data

Best For

- Teams that need automation but are not ready to switch to a dedicated platform

Common Pitfalls to Avoid

While AI tools can bring many important advantages to your team, there are also some potential pitfalls that you should do everything possible to avoid. Here are the most common mistakes we see:

Choosing "AI" That Isn't Really AI

Many tools marketed as "AI-powered" are just traditional rule-based automation with better marketing. True AI accounting software should:

- Learn from your specific data patterns over time

- Handle edge cases intelligently without manual rule creation

- Improve accuracy as it processes more transactions

- Provide explanations for its decisions and recommendations

Red flags: Tools that require extensive manual rule setup, can't handle unusual transactions, or show no improvement in accuracy over time.

Overestimating Implementation Speed

AI accounting software needs time to learn your patterns before delivering full value. Even quick-setup platforms require:

- Data training period: 1-3 months for the AI to learn your transaction patterns

- Team adoption time: 2-4 weeks for your team to adjust workflows

- Integration refinement: Ongoing optimization of system connections and processes

Plan for gradual rollout rather than expecting immediate transformation.

Underestimating Change Management

The most sophisticated AI is useless if your team doesn't adopt it properly. Successful implementations include:

- Clear communication about why the change is happening and how it benefits the team

- Comprehensive training on new workflows and features

- Ongoing support during the transition period

- Measurement and feedback to track adoption and identify issues

Choosing Features Over Fit

It's tempting to choose the platform with the longest feature list, but the best AI accounting software is the one that solves your specific problems well.

Focus on platforms that excel in your primary use cases rather than those that claim to do everything. A tool that transforms your reconciliation process is more valuable than one that adds marginal improvements to twenty different workflows.

Why AI Alone Won't Solve Your Close Challenges

AI automation is just one piece of an effective month-end close. Even the most sophisticated AI can't overcome fundamental process issues.

AI can't fix poor process structure. If your close lacks clear task dependencies, deadline tracking, and accountability measures, automation won't eliminate bottlenecks – it might even hide them until they become critical.

AI can't replace professional judgment. While AI excels at pattern recognition and routine tasks, complex accounting decisions still require human expertise. The best AI accounting software amplifies your team's capabilities rather than attempting to replace them.

AI can't ensure team collaboration. Month-end close success depends on coordinated effort across multiple team members. AI can provide better visibility and communication tools, but it can't force good teamwork.

This is why platforms like Numeric combine AI automation with structured workflow management, real-time collaboration tools, and comprehensive audit trails. The AI handles routine tasks and provides intelligent insights, while the platform structure ensures your team can execute an efficient, controlled close process.

Bottom Line

AI accounting software has moved beyond the hype phase – the tools that work are delivering real productivity gains for accounting teams managing complex workflows. The difference between success and disappointment comes down to choosing software that solves your actual pain points rather than just claiming to be "AI-powered."

The most effective implementations focus on specific workflow improvements: eliminating manual reconciliation work, reducing human errors, accelerating variance analysis, or automating routine categorization tasks. Generic AI features rarely move the needle; targeted intelligence that learns your team's patterns and processes creates genuine value.

Remember that the best AI accounting software enhances what experienced accountants already do well. If you're a Controller juggling multiple entities, AI should help you spot exceptions faster and focus on analysis. If you're managing a close cycle, AI should predict bottlenecks and automate routine tasks, not attempt to replace your professional judgment.

The accounting teams seeing the biggest wins are those that view AI as a force multiplier for expertise, not a replacement for it.

To leverage AI to revolutionize your accounting processes, schedule a personalized demo of Numeric.

FAQs

What Are the Benefits of Using AI in Accounting?

AI accounting software goes beyond basic automation by learning from your data patterns and continuously improving performance. Key benefits include: reduced manual data entry and categorization work, faster identification of reconciliation exceptions and anomalies, predictive insights for cash flow and close timeline management, and automated generation of variance explanations and audit documentation. The most significant benefit is freeing up your team's time for strategic analysis rather than routine processing.

Is AI Software Only Relevant for Large Teams?

No, AI accounting software can benefit teams of all sizes, but the optimal solution varies significantly based on company size and complexity. Small businesses (under 50 employees) often benefit most from AI-enhanced bookkeeping platforms like QuickBooks or Zeni. Mid-sized companies (50-500 employees) typically see the biggest impact from specialized tools like Numeric for close management or Ramp for AP automation. Large enterprises (500+ employees) can leverage comprehensive AI platforms with advanced analytics and multi-entity capabilities.

How Do I Know If My Accounting Team Is Ready for AI?

Your team is likely ready for AI accounting software if you're experiencing: manual processes that consume disproportionate time relative to their complexity, frequent month-end close delays due to routine tasks rather than complex analysis, reconciliation errors that require extensive investigation to resolve, or difficulty scaling accounting processes as transaction volume grows. If your team spends more time on data processing than data analysis, AI can provide significant value.

What Should I Look for When Comparing AI Accounting Tools?

It’s best to focus on software that offers the features that your team needs, without unnecessary complication. Also pay attention to integrations with the tools that you’re already using, the implementation and setup process, the available customer support, and - of course - the total cost. Don’t forget to check out customer reviews on reputable third-party websites.

How Long Does It Take to Implement AI Accounting Software?

Implementation time depends on the specific tool as well as your company’s processes, data, and integration complexities. For instance, getting started with Numeric takes a few days, while platforms like Trullion and Vic.ai might require 2-6 weeks for AI training.

Is AI in Accounting Secure and Reliable?

Ultimately, the security and reliability of the use of AI for accounting software depends on the specific platform. Having said that, most AI accounting tools - and definitely the ones included in our ranking - are built with enterprise-grade security features, including SOC 2 compliance, data encryption, and access controls.

.png)

.png)