Finance Automation in 2026: Strategy, Frameworks, + Tools

.png)

If you had to guess: what percentage of finance teams are still relying entirely on manual processes?

According to a survey from fintech platform Rossum, the answer is 49%. That number should feel surprisingly high.

In fact, the same survey states that only 13% of finance departments are considered “fully automated” – but that definition is loose. In Rossum’s terms, “fully automated" simply means that half or more of a team’s document processing runs straight-through without human touch. In other words, even among the most advanced teams, as much as half of all finance work still happens via spreadsheet work, manual reconciliations, and ad hoc workflows.

For the 49% that have yet to embrace automation at all, these manual processes occupy 100% of their finance team’s time and resources.

Finance automation can reduce that manual work by up to 90%. With the right tools, it’s possible to automate tasks like invoice approvals, variance explanations, and even the majority of the close process.. That newfound efficiency can empower finance teams to do a lot less busy work and focus their attention on work that matters.

This is our practical guide to making the most of finance automation in 2025.

Key takeaways:

- Finance automation can reduce manual work by 50–90%, benefiting team productivity and improving reporting accuracy and speed

- All core finance workflows can be automated to some extent: AP/AR, expenses, payroll, reconciliations, month-end close, reporting, and forecasting

- To implement automation successfully, use a structured framework: audit, start small, prioritize high-impact wins, and scale strategically

- Teams can find provable value and attain ROI quickly with the prebuilt automations offered by platforms like Numeric

What is Finance Automation?

Finance automation refers to the use of technology to reduce manual processes in accounting and finance workflows. Finance automation tools can help teams capture, process, reconcile, and report on financial data more efficiently without compromising on accuracy.

Automation creates efficiency, but that doesn’t mean it can replace your finance team. Teams who embrace automation generally find that their workflows become both scalable and repeatable; this means less time spent on basic work and more time spent on analysis, planning, and partnership with other units across the organization.

What’s Driving the Demand for Finance Automation?

Speed & Accuracy Expectations

Business leaders expect faster closes, but never at the expense of accuracy. The only way to ensure both accuracy and speed is to implement repeatable processes that present fewer edge cases or exceptions, reducing the need for human intervention.

Volume & Complexity Growth

As a business grows or undergoes M&A, the volume of transactions increases. So does accounting complexity, especially when multiple entities or geographies are concerned.

Data Availability

Financial data is increasingly available in real time, which means your finance team may be acting as the bottleneck preventing the organization from making agile decisions based on this data. One commonly-cited solution is to automate parts of the processing and reporting cycle.

Shift Toward Strategic Finance

The most effective finance teams are evolving from pure reporting into a more strategic advisory role involving deep analysis and scenario modeling. This change can make the entire organization more competitive by providing a stream of actionable, data-driven insights.

Automation as Augmentation, Not Displacement

We get this question all the time at Numeric: is AI going to make the accountant go extinct?

We don’t think so.

AI and finance automation take the repetitive tasks that your team hates doing, and makes them less painful. As these tools become more entrenched across industries and use cases, accountants and analysts will spend less time processing and more time problem-solving.

Take the monthly close process: automation can handle reconciliations, recurring entries, and tie-outs. Effective immediately, your team can now use that time to do deeper work. They can investigate variances, liaise with department leads, or generate detailed insights.

Furthermore, finance automation isn’t necessarily “set and forget”. An accountant should always be in the loop to oversee processes and fine-tune reporting. This is another area where strategic partnership adds value; familiarity with the organization’s high-level needs means an accountant can leverage these powerful tools to deliver more effective insights.

When implemented well, automation becomes a lever for success. This is true at the organizational, team, and personal levels. As it’s often pointed out: technology is the engine and the human is the steering wheel.

What Powers Finance Automation?

Robotic Process Automation (RPA)

Robotic Process Automation, or RPA, is a technology that enables the automation of repetitive, manual tasks. It involves using software (actually, bots—hence the term “robotic”) to simulate human actions and perform tasks that would otherwise be done manually.

Today, RPA is best applied to repetitive tasks. For example, an accounting team can use RPA to automate the distribution of financial reports. The bot can run predefined reports in your accounting system, export them, rename them according to predefined conventions, and distribute them to a mailing list or upload them to a document management system. Deploying these bots is relatively straightforward, and can be done even on older ERP systems that lack APIs.

Like many forms of automation, RPA can perform repetitive tasks with ease. Where it struggles, however, is with irregularity. Try to limit edge cases or the presence of unstructured data when using RPA, or find supplemental ways for your bot to maneuver around irregularities in the data.

Intelligent Automation

If Robotic Process Automation focuses on automating simple human actions, Intelligent Automation enhances this with cognitive capabilities like understanding, classification, and extraction.

By leveraging AI and machine learning, Intelligent Automation upgrades standard RPA into a more flexible, adaptable system that can interpret data, make decisions, and handle variability.

For instance: while standard optical character recognition (OCR) can convert images or PDFs into raw text, intelligent document processing combines OCR with machine learning to interpret the structure and meaning of documents. So, a given PDF or invoice may have line items or graphics in unexpected places, or may simply be formatted in a way that your system isn’t familiar with. While this would confuse a standard RPA system, OCR paired with ML is able to resolve these irregularities and extract the data you need.

In addition, Intelligent Automation systems learn over time with training. ChatGPT’s large language models like GPT-4 and GPT-5 have been trained on mountains of data; likewise, an AI-powered processing tool is trained on the documents you give it, each time improving and incorporating the new inputs.

These tools bridge the gap between traditional robotic tools and AI-native platforms, which represent the real next evolution of financial automation.

Listen to Jason Pikoos tackle the topic of intelligent automation on the Incoming Statements podcast!

AI-Native Automation

We’ve covered how bots mimic human action and thought. AI-native automation is how they mimic human beings.

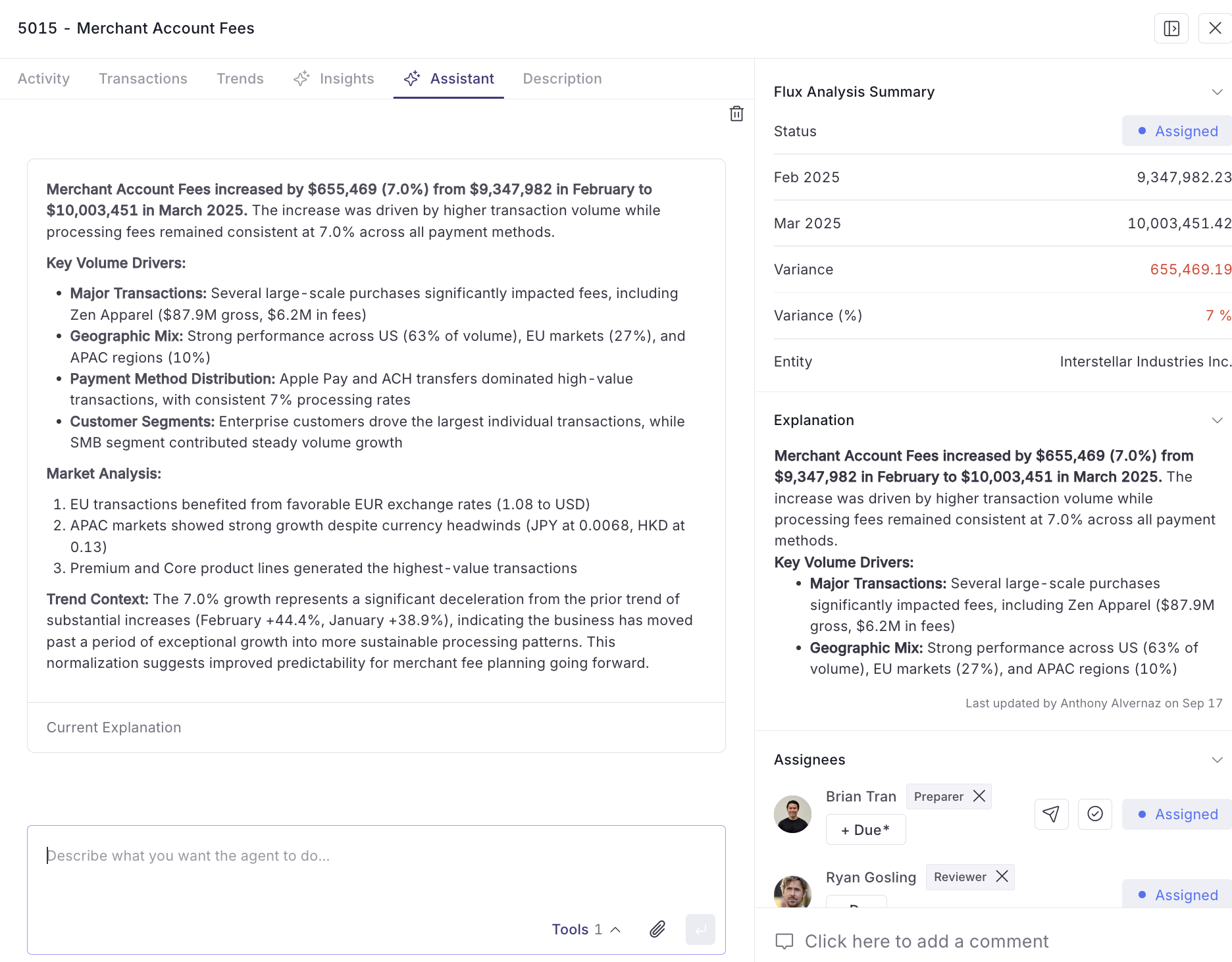

AI-native automation means using AI agents that learn and adapt continuously. An agent can auto-generate reconciliation summaries, draft flux explanations, and detect outlier journal entries with minimal hand-holding. Think of these agents as intelligent assistants who build on your team’s outputs in creative, impactful ways.

Agentic AI is at the razor’s edge of innovation across nearly every industry. If you’re a CFO, you’ve no doubt heard of this tech from other business leaders; now’s the time to invest in your own understanding. AI-native automation and agentic bots have the potential to reshape the finance teams in foundational ways, and the next 2-3 years will present opportunities for leaders to implement and develop these tools.

Numeric – the #1 automation platform for the close

Where Finance Automation Applies (Key Workflows and Functions)

To move beyond the theoretical: what are actual tasks that automation can help your team address?

Below, we’ve compiled a non-exhaustive gallery of finance activities, broken down by function, that we’ve seen organizations successfully automate with the help of RPA and AI.

Transactional Processes

Transactional processes are ripe for automation because they’re repetitive and high-volume. If you have 400 invoices which all need the same 8 steps to be processed, it’s preferable to automate as much of the workflow as you can. A human will never perform these tasks as quickly or as well as a machine.

Accounts Payable

- Automated invoice capture via OCR/AI

- Automated approval workflows

- Payment scheduling and reporting

Accounts Receivable

- Auto-matching payments to invoices

- Dunning letter automation

- Cash application and reconciliation

Payroll & Expenses

- Automated policy compliance checks

- Streamlined approval routing

- Employee reimbursement processing

Accounting & Close

The month-end, quarter-end, and year-end closes are automatable insofar as they consist of sequential, repetitive tasks. Data collection and reconciliation, as well as generation of documents, can be left up to an automated process, while team members can instead focus on variance, judgment, and communication with stakeholders.

- Reconciliations: Auto-match subledger and bank transactions with the GL

- Journal Entries: Automatically generate and post recurring entries (e.g., accruals, deferrals)

- Month-End Close: Reduce manual tie-outs and maintain progress dashboards

Planning & Analysis

When it comes to FP&A, your team’s time is best spent explaining and contextualizing the analysis. If your accountants are spending a significant amount of time on data plumbing (e.g., pulling and consolidating data, updating spreadsheets, creating reports) when a machine could do the same job faster, it leaves them with less time for more nuanced and potentially impactful work.

- Automate budget roll-ups and consolidation across departments

- Use AI to forecast revenue, cash flow, and expenses based on historical and real-time data

- Automate flux reporting with tools that are trained to flag significant deviations

- Generate executive-ready reports at a predetermined cadence

Compliance & Risk

Compliance and risk experts can be among your team’s most valuable assets. Maximizing their value requires unburdening them from tedious manual tasks, and instead refocusing their energies on judgment, interpretation, and communication.

- Automatically log every action, approval, and change with full transparency and access control

- Centralize supporting documentation and maintain strict evidence capture

- Generate recurring reports with standardized data pulls

- Validate against controls and filing requirements, with the option to flag discrepancies

Where Does AI and GenAI Fit In?

We’ve mentioned that AI can upgrade robotic processes to become self-improving. Now, let’s drill down into how that dynamic can apply to your accounting workflows.

Automation + Adaptation

The rules that drive Robotic Process Automation are static. RPA can follow “if/then” statements or specific instructions given by a human, and can only leverage structured data. AI, on the other hand, allows the bot to continually incorporate new information and update its processing accordingly.

This unlocks:

- The ability to read and extract key terms from contracts, receipts, or invoices

- Automatic mapping of data fields to GL codes

- Regular user feedback to improve and clarify processing

So, while RPA is still providing the actual muscle to process your documents and data, AI is the brain that directs that muscle to work more effectively and efficiently.

Predictive and Prescriptive Capabilities

With AI, you gain access to more than just additional processing capacity. The technology is designed to replicate human understanding, and as such can address the predictive and prescriptive needs of your organization.

For example, a well-implemented and trained AI can:

- Predict late payments based on customer behavior

- Flag journal entries that deviate from historical norms

- Suggest corrective actions before issues snowball

- Determine likely bottlenecks for an upcoming month-end close

Note that these tools become more effective at such tasks over time and with input from your team. Therefore, implementing sooner will lead to your model being game-ready sooner, which will in turn unlock proactive opportunities for your finance and leadership teams.

Generative AI for Finance

Generative AI refers to a category of artificial intelligence that can create new content (like text, images, audio, code, or video) based on patterns it learns from existing data. (Popular large language models like ChatGPT, Claude, Gemini, and Grok all qualify as GenAI models.)

GenAI is everywhere online, but how does it help your finance team? To name a few examples:

- Relative to a human, GenAI can draft variance explanations in a fraction of the time

- Narrative commentary for reports (and the reports themselves) can be drafted with GenAI

- Writing, editing, and formatting is faster and easier with AI assistance

- Graphics and visualizations can be generated in seconds based on simple data inputs

Keep in mind: Generative AI has limitations. Not only is a human required to provide adequate instructions (called “prompts”) for the AI to actually undertake a task, but these models’ outputs often require significant editing and fact-checking before they’re ready for public consumption.

Ultimately, your AI is only as good as the team that’s using it.

Key Considerations for Finance Leaders

If you’re a CFO, why not simply automate everything right now?

That’s like asking a chef why they don’t just throw every dish in the microwave.

The point is not automation for its own sake, but rather for the sake of leveraging your team’s existing structure and expertise to deliver better results. Here’s how to serve up a successful automation strategy without losing sight of the bigger picture.

Process Readiness

Automation is successful when processes are already functional.There’s no point in automating processes that are broken to begin with. Before automating, develop a clear picture of your team’s current workflows and determine which ones can be cleaned up before automating anything.

Then, to identify the low-hanging fruit:

- Look for high-volume, repetitive workflows that leverage structured data (e.g., invoice intake, reconciliations)

- Provide your team with guidance on how to audit existing workflows for automation potential, with an emphasis on identifying manual pain points

- Determine implied complexity and necessary timeline for implementing automation, workflow by workflow

Next, you’ll want to match the workflows to the tech best suited to automate them.

Technology Fit

Different workflows are suited to different automation tools. Counterintuitively, the complexity of the process is not the determining factor for which tool is required; rather, it’s the degree of irregularity in both the data and the desired output.

- Low irregularity: Robotic Process Automation (RPA)

Good for structured, rules-based workflows (e.g., invoice processing)

- Some irregularity: AI and Machine Learning-enabled automation

Can handle semi-structured or exception-heavy data (e.g., expense classification)

- Irregular, creative: Agentic AI

Able to generate new content and automate cross-functional workflows

There’s no such thing as an all-in-one tool that can automate every process. AI Agents, for example, could process the same workflows as RPA , but would be less suited to the volume and might be too difficult to implement and maintain.

You wouldn’t try to drill a hole using a screwdriver. Make your life easier by using the tool that makes sense.

Governance, Risk, Data Security & Privacy

Compliance, privacy, and security needs should factor into any automation strategy from day one.

If you neglect to account for the specifics of these requirements, or tack them on at the end of the implementation, your team may find themselves backtracking or redoing work that was assumed to be complete. And that can threaten the ROI of your entire implementation.

Common considerations in this domain include:

- Compliance: SOC 2, GDPR, and other standards

- Security: Encryption, access controls, and audit trails

- Bias & Transparency: Understanding how AI models make decisions

Addressing these considerations, however, requires more than a couple of slides in a deck.

Develop clear governance frameworks and controls with cross-functional input from finance, IT, and legal. Make sure tools are vetted not only for performance, but for their ability to log actions, enforce policies, and provide auditability at scale.

Organizational Change Readiness

No matter your strategy, automation will change roles and workflows across your team. In the long run, these changes will have a positive impact on individual team members. Efficiency, satisfaction, and development are all downstream of doing more fulfilling work.

However, change is disruptive by nature. Finance leaders need to:

- Set clear expectations for the implementation, and for what comes next

- Offer training and structured communication channels

- Reinforce automation as an enabler, not a threat

If your team doesn’t embrace your finance automation initiative, it won’t get off the ground. Obtain buy-in by persuading team members to see automation as an opportunity to do better work.

Building vs Buying Finance Automation

It’s a choice faced by leaders in any industry who want to create organizational change through technology: do we build internally, buy an off-the-shelf solution, or take a hybrid approach? Each option comes with trade-offs around speed, cost, flexibility, and risk.

The Benefits of Building In-House

Flexibility

Building automation internally gives you full control over the design and implementation. This makes sense for organizations with highly specialized workflows or regulatory requirements that off-the-shelf tools don’t cleanly accommodate.

Control

When your internal team owns the automation stack, you control everything: data governance, update cycles, and even the IP. Organizations with strict security policies or proprietary processes may find this aspect uniquely valuable.

Potential Trade-offs

- High upfront costs and long development cycles (often 12–18 months)

- Ongoing maintenance and technical debt fall on internal IT/engineering

- Harder to keep pace with fast-evolving AI/automation capabilities.

Example:

Instead of using a dedicated close management platform, some teams choose to build custom reconciliation and journal-entry workflows inside their ERP instead. While feasible, this will require extensive developer hours and risks missing out on the UI and reporting features of a purpose-built tool.

Advantages of Buying a Purpose-Built Solution

Speed

Deployment timelines are typically measured in days or weeks, not months. Modern SaaS platforms are designed for rapid onboarding and easy configuration, and access to a dedicated customer success team is usually included.

Lower Upfront Cost

Most vendors use a subscription model, making automation more accessible and reducing the upfront capital expenditure.

Built-In Reliability

SaaS tools are built with APIs, compliance certifications (e.g., SOC 2, GDPR), security features, and regular update support. All this is delivered with minimal lift from your internal IT team.

Potential Trade-offs

- Your processes may need to adapt to the tool’s design, not the other way around.

- Vendor lock-in and pricing complexity can become concerns over time.

Example:

Instead of building your own invoice OCR, going with a full-fledged Accounts Payable automation tool like Tipalti or Bill.com lets your team scale payables instantly, with no custom dev work required.

Hybrid and “Buy-to-Build” Approaches

What It Is

The hybrid model involves buying a core automation platform and customizing it with light development or scripting to meet specific team needs.

Why It Works

CFOs are drawn to this approach because it combines vendor reliability with internal adaptability. It’s a happy medium that derisks the most extreme aspects of the build vs. buy dichotomy.

Examples:

- Use Numeric to automate core close tasks while building lightweight RPA scripts to meet department-specific reporting requirements.

- Implement an API-first platform that allows your team to build custom dashboards or modular components as needed.

Integration and Scalability Considerations

The finance automation tool of your dreams can still come up short without a well-managed integration and scalability plan.

Integration

Finance automation doesn’t live in a vacuum. Your core systems like ERP, CRM, and HRIS are where transactions are recorded and the majority of data lives. Obviously, your automation tools must be able to connect to these systems.

If robust, dependable connections are your top priority (because, for example, your internal IT team lacks the bandwidth to troubleshoot problematic connections), then a SaaS platform may be preferable to a custom-built solution.. SaaS vendors provide pre-built connectors and APIs, and have experience optimizing these connections for existing clients.

Internal builds, on the other hand, require custom integrations. These can become brittle over time and may be difficult for an internal team to maintain.

Scalability

As your organization grows:

- In-house tools may struggle to keep up due to limited IT bandwidth, increasing complexity, or changes in compliance requirements.

- SaaS vendors scale quickly, but may limit customization or introduce dependencies.

Imagine spending months (or even years) scoping out and building a custom solution, only to undergo organizational change that renders it inadequate. Partnering with a SaaS vendor may not check every box, but they’re battle-tested and usually designed to scale with your needs.

ROI of Finance Automation

Finance automation can create efficiencies, and therefore cost savings. But the real ROI of automation is reclaimed time, superior insights, and faster decision-making. Every CFO has projects or analysis on the back burner that they wish their team had time for. If automation can slash the resources required to accomplish routine tasks, these more sophisticated projects can suddenly become feasible.

But it takes time to develop the capacity for that higher-level work. That’s why ROI should be considered on an ongoing basis, rather than as discretionary one-time expense and return.

Here’s how to measure the ROI of finance automation in a more comprehensive way.

Efficiency and Accuracy Gains

Automation drives value by eliminating manual steps, reducing errors, and freeing up capacity for higher-value tasks. Every step that can be automated is one less hurdle for your team members to clear.

To estimate the ROI achieved through automation, track metrics like:

- Time saved: Days off the close cycle, faster invoice processing, shorter DSO

- Error reduction: Fewer manual reconciliations and audit adjustments

- Capacity reallocation: Hours shifted from transactional work to planning, analysis, or business partnering

Strategic ROI Beyond Cost Savings

Cost savings are immediately reflected in your organization’s bottom line, which makes them obvious wins. But finance leaders should consider broadening the ROI lens to include qualitative gains like:

- Agility: Faster and more frequent insights to inform agile executive decisions

- Employee Impact: Reduced burnout, greater job satisfaction, and higher retention

- Compliance & Risk: More consistent audit readiness and fewer surprises

Even if these gains are qualitative at first, given enough time they will yield quantitative returns. By building a better finance department, you’re building a better company.

Building Your ROI Scorecard

Before launching an automation initiative, a simple scorecard to measure progress and justify the investment can help set expectations across your organization. Clearly-defined KPIs will help you measure the eventual success of your implementation, but will also encourage buy-in even prior to project kickoff.

Here are a few KPIs to consider:

Baseline Metrics

- Close cycle time

- Invoice or journal entry error rates

- Manual hours by workflow

Performance Metrics

- Time saved or accelerated processing

- Error reduction or audit improvements

- Automation coverage (as a % of workflows)

Strategic Metrics

- Forecast accuracy improvements

- Time-to-insight for reports

- Team satisfaction or reduced attrition

Taken together, these metrics tell the story of a successful finance automation implementation: baseline metrics improve, which lifts team performance metrics, which leads to strategic improvements.

Common Automation Pitfalls and How to Avoid Them

Finance automation (and particularly its latest and greatest iterations, like Agentic AI) is new. Like any new way of doing business, it’s common to encounter pitfalls, disappointments, and false starts. Fortunately, this space is now sufficiently developed that we can catalogue where others have stumbled and acknowledge the value of such cautionary tales.

Automating Broken Processes

Automation doesn't fix broken workflows. Before you invest time and resources in deploying an automation that only makes the problem worse, look for opportunities to:

- Audit for redundancies, bottlenecks, and manual workarounds

- Execute smaller, easier “pilot” implementations first

- Map the desired future state, not just the current one

Automation aside, it’s always a useful exercise to evaluate your team’s workflows. Take these opportunities to envision which tasks might be improved and eventually automated, then brainstorm how your team could spend their newfound time.

Overlooking Change Management

Finance automation consists of a set of tools, workflows, and outputs. Its biggest impact, however, is on people.

Failing to account for the human element (meaning your team and the stakeholders who rely on them) can complicate an otherwise sound implementation. Common examples include:

- End user resistance or fear of job displacement

- Lack of communication, unclear expectations, and unrealistic KPIs

- No feedback loop to improve adoption

What helps:

- Training programs and onboarding materials that position the accountant as a workflow manager, not just a workhorse

- Nominating and training change agents within each team

- Ongoing communication that frames automation as augmentation, not replacement

When automation is successful, your team is more successful. By the same token, if your organization doesn’t automate repetitive finance workflows, your accountants won’t develop the skills necessary to thrive in a paradigm of accountants as strategic cross-functional partners.

Poor Data Quality

It’s an old adage that holds true in any field dealing with data: garbage in, garbage out. If your source data is messy, automation will only make for a more efficient mess.

Here’s a pre-automation checklist to help declutter your data:

- Clean up vendor names, chart of accounts, and entity codes

- Establish naming conventions and field validation

- Run a governance audit on master data and reporting structures

Without high-quality data, there’s no chance of high-quality outputs. Having orderly data inputs will put your team in a position to deliver.

Investing Too Much, Automating Too Fast

It can be tempting to aim for full automation in one fell swoop. If some automation can create efficiencies and improve my team’s workflows, surely more automation will have more of an impact?

Not so fast. Kicking off a massive automation initiative cranks up the risk without targeting a realistic payoff.

In Numeric’s experience, the following gradual approach can be preferable:

- Start with focused use cases (e.g., AP automation, close checklists)

- Measure impact, then expand scope based on lessons learned

- Avoid open-ended “transformation” projects that never finish

Piece by piece, automation will level up your organization’s finance functions. But it’s important to walk before you run (and look before you leap).

Ignoring Security and Compliance

Finance automation can’t be separated from privacy, audit, and control requirements. Organizations who deal with sensitive data need to be careful when taking a human out of the loop, because responsibility and common sense (which machines, as of now, don’t have) can keep mistakes from happening.

That’s why extra attention must be paid to established requirements. Don’t overlook:

- SOC 2 Type II compliance

- GDPR adherence

- Encryption and role-based access control

- Immutable audit logs

Failing to build governance upfront can derail implementation and risk stakeholder trust.If ever in doubt, double check that the bots in charge of your work are adhering to the same guidelines that a human would.

What’s On the Horizon for Finance Automation

Emerging technologies like the ones that drive finance automation are exciting and full of potential. Five years ago, the concept of a bot that makes decisions and creates content from scratch would’ve sounded like science fiction. Today, this tech is everywhere.

Five years from now, where will we find ourselves?

Emerging Technologies

Finance automation will keep evolving alongside the AI landscape. Expect to see:

- Hyperautomation: End-to-end orchestration across finance, HR, legal, and ops

- Blockchain: Improved transparency for intercompany transactions and reconciliations

- Natural Language Interfaces: AI that can process and respond to spoken or typed queries from finance users

The Autonomous Finance Function

The future isn’t just automation. It’s self-optimizing and self-teaching automation.

Emerging capabilities in the automation space include:

- Self-learning systems that improve without human prompts

- Predictive error correction that flags and fixes issues in-flight

- Real-time continuous close that makes monthly crunches obsolete

Preparing Your Team for Tomorrow

As tools evolve, so should the people who use them.

Essential skills for the next-generation finance team include:

- Strategic Insight: Connect numbers to business narratives

- Storytelling: Present data persuasively across the org

- Collaboration: Partner with product, ops, and IT for contextualized analysis

- Adaptability: Embrace new tools and approaches with a growth mindset

Also, expect to see new roles emerge on finance teams both big and small:

- Automation project managers

- Data quality analysts

- AI copilots or tool integrators

Conclusion

Finance automation isn’t just about saving time. It’s about unlocking your team’s full potential and embedding them as valuable partners within your organization.

When implemented judiciously, finance automation improves accuracy, accelerates reporting, empowers strategic insight, and makes room for more rewarding work.

The tools are ready. The benefits are clear. But success requires preparation.

Start by mapping your workflows. Identify areas of pain and potential, then test, learn, iterate, and scale up. If you have doubts, look for tools that offer reliability, extensibility, and measurable value. Numeric and other finance-focused platforms are a perfect place to start.

.png)

.png)