The Push Toward "Proactive": A Month-End Close Maturity Model

.png)

Where does your close process stand? How does your month-end close stack up against others in the industry?

Often the fastest (but only remotely helpful) yardstick available is comparing days to close.

But benchmarks on how long accounting teams take to close leave out nuances specific to your industry, dependencies across entities or departments, and accounting team size.

A 5 day close on one team may still be rife with inefficiency. A 7 day close on another team may be a well-oiled, insightful machine. So, we feel it’s more important to evaluate close processes qualitatively than through rigid quantitative metrics.

Below, we’ll walk through our month-end close maturity model – a reference we created so teams can see where their close process currently stands and where it can evolve next.

Month-end Close Maturity Model Stages

This model isn’t built on assumptions; it’s the product of hundreds of conversations we’ve had with accounting teams and consultants about the makeup of company closes.

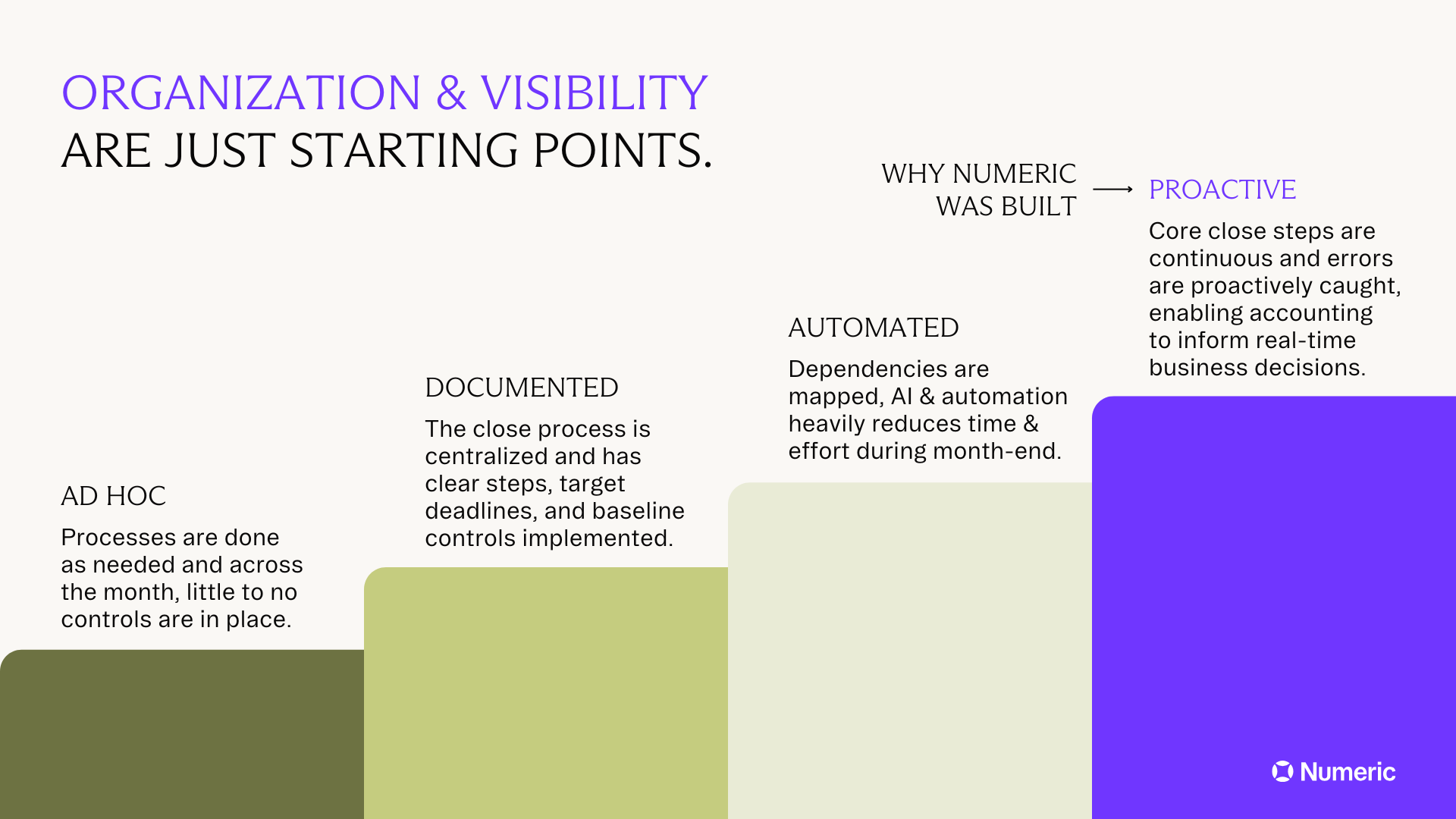

These are the four core stages of close maturity:

- Ad Hoc: Processes are done as needed and across the month, little to no controls are in place.

- Documented: The close process is centralized and has clear steps, target deadlines, and baseline controls implemented.

- Automated: Dependencies are mapped, AI & automation heavily reduce time & effort during month-end.

- Proactive: Core close steps are continuous and errors are proactively caught, enabling accounting to inform real-time business decisions.

Next, we’ve broken down core characteristics of each stage, common challenges, and actions to progress to the next level of maturity.

Stage 1: Ad Hoc

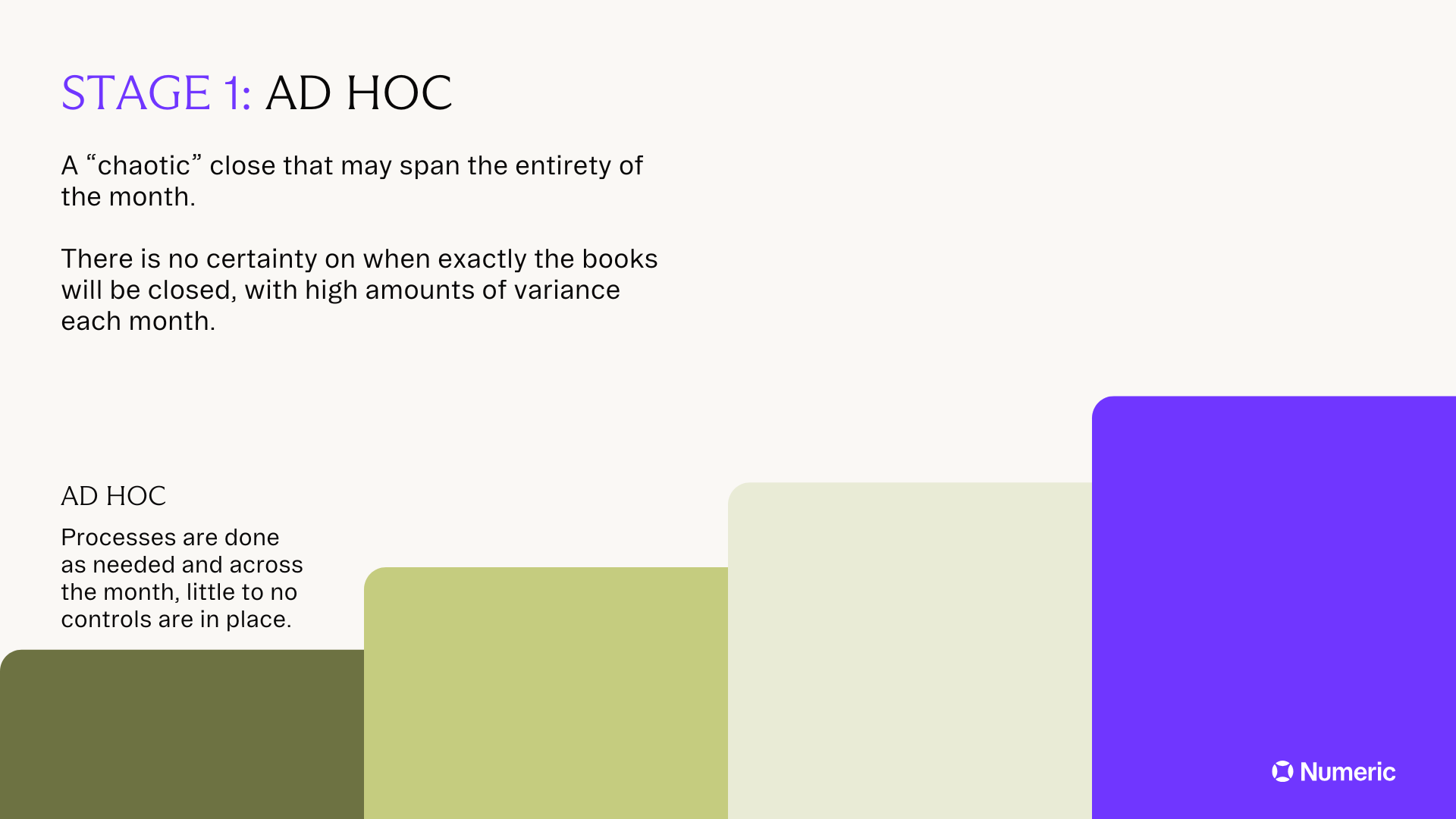

Month-end close processes in the Ad Hoc stage, perhaps the easiest stage to identify, are disorganized and tend to look different month-to-month. Each month can feel like a scramble. Periods are frequently re-opened and the close process tends to be focused on the basics of core accounts, like cash, revenue, and payroll.

Core Characteristics of the AdHoc Stage

- A “perpetual” close that may span the entirety of the month

- Process knowledge is “remembered” and relies on team members who’ve done it before

- Any team shifts, new hires, or PTO is disruptive and often results in balls being dropped

- Slacks and emails are volleyed back and forth to understand where everything stands and what’s behind schedule

- There is no certainty on when exactly the books will be closed, with high amounts of variance each month

Key Value Provided at the Ad Hoc Stage

Month-end drags on and on — leaving little time for work that’s not directly related to the close. The value that the accounting team provides is baseline compliance and covering bases for invoices, payroll, bills, etc.

In most organizations, accounting teams at this stage are removed from business decisions and can be perceived as existing to check necessary boxes for the business to continue functioning.

The core challenge is simply keeping up with the pace of business progress and getting to a level of completeness needed that the period can be closed.

How to Progress Beyond the Ad Hoc Stage

If you read the above characteristics and it all rings true — don’t worry. Everyone begins somewhere.

Often, there’s legitimate rationale behind ad hoc closing — your accounting team may be barebones, you’re far away from an audit, or the business is small enough that this style of closing is adequate.

Yet as the company grows, Ad Hoc closing fails to scale and the importance of having sound, reliable financials increases. The first step in making the leap to a documented close is taking pen to paper and drafting out a month-end close checklist.

Begin building SOPs for close tasks, noting the preparers, reviewers, and target due dates (to assist, you can also use our templates to get a head start.) Then each additional close, layer in context, tighten timelines, and start committing set dates to your business for when financials will be ready.

Stage 2: Documented

Accounting teams generally uplevel their month-end process to the “Documented” stage in response to an upcoming audit, a new Controller or finance hire stepping in, or due to the downstream effects of an Ad Hoc close process piling up.

At this stage, the close starts to feel more manageable and has a clear end in sight. There’s a known, repeatable playbook which enables the team to make incremental improvements over time and, consequently, days continue to be shaved off the close.

Core Characteristics at the Documented Stage

- The team sets (and hits) clear targets for days to close

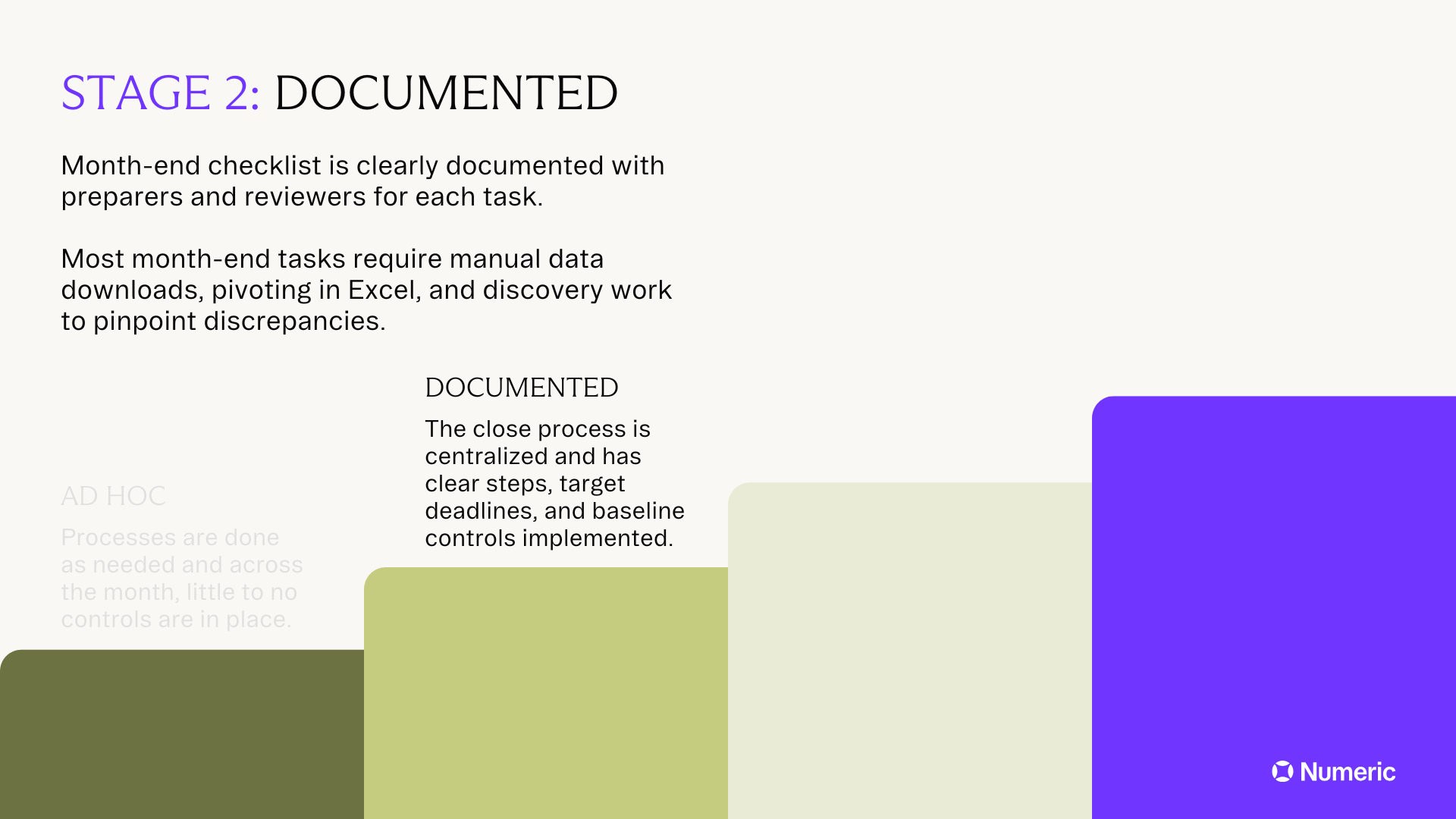

- The month-end checklist is clearly documented with preparers and reviewers for each task

- Audit-readiness is built into the month-end process with clear documentation, processes, and organization

- The status of the close is clearly visible for the team often within a close management tool, preventing constant email or Slack updates

- Most month-end tasks require manual data downloads, pivoting in Excel, and discovery work to pinpoint discrepancies

- The bulk of time is spent completing tasks related to accuracy of the underlying financial data

Key Value Provided at the Documented Stage

With a clear, organized close process, the accounting team now reliably provides financial data to the business on a known date. At this stage, the value of the team begins to expand beyond “box checking” as financial data is known to be accurate and actionable. With reliable month-end reporting, the accounting team begins to provide a clear picture of the business’ financial health.

While the team is leagues beyond the value provided in the Ad Hoc stage, given the volume of manual tasks required in the month-end close, there remains little time for one-off projects or real advising to the business.

How to Progress Beyond the Documented Stage

Getting to this step alone is a huge achievement. You’re likely audit-ready and have made strides in compressing your time to close.

The key to advancing to an automated close starts with your well documented month-end checklist. Which steps are taking up the lion’s share of time? Which steps are most often pushed? As the business grows, in what areas will you actively need to hire additional headcount if processes remain as is? Sometimes, adding in (or converting a current employee to) an accounting operations role can make a big difference.

Pick one or two friction points and carve out time to research if a systems integration, a new software, or an existing feature of your current software could automate some or all of the manual work involved.

Learn to Master Your Month-End Close

Stage 3: Automated

Naturally, once a close process has been clearly documented, inefficiencies become clearer.

The next stage in maturity requires a concerted effort to automate manual work across the close process by evaluating all components of the close for possible efficiency gains.

While arriving at the Documented stage consisted of creating a clear month-end checklist, the focus of the “Automated” stage is eliminating the manual work involved in as many of the checklist tasks as possible.

This stage heavily relies on a strong accounting tech stack and typically translates to a faster close with greater accuracy, even as the company scales and accounting headcount remains constant. Team members increasingly shift from “preparer” to “reviewer” roles, with automation across the tech stack taking the first pass at manual tasks.

Core Characteristics of the Automated Stage

- ERP integrations with core tools, like those for payroll, payment processing, or AP reduce manual data entry across the month and streamline month-end accuracy checks

- Controls are validated with a systems audit report, instead of a manual compensating control

- Reconciliations are all housed in a central location, integrating workpapers and ERP trial balances, and recons are auto-submitted or simply reviewed

- OCR is used to scan bank statements and large documents, automatically pulling key balances used for reconciliation or other workflows

- Adjusting journal entries are drafted on auto-pilot for review and posting by team members

- Prior periods are automatically monitored for any shifts and team members are notified of changes to investigate

- Discovery work in Excel is cut to a minimum with exact transactions flagged since accounts were last reconciled

- AI-handles the first pass at scanning every transaction and identifying key drivers of change in flux explanations

- Recurring tasks, like emails for legal accruals, have been automated each month

Key Value Provided at the Automated Stage

With a compressed close timeline, the accounting team increasingly spends more time on analysis and pulling insights from underlying data. Flux explanations provide a clear portrait of material changes in the business and reporting is reliable, actionable, and fast enough to inform a larger array of business decisions.

With less time spent on manual, recurring tasks, the accounting team is now able to provide real line of sight into business operations and has the bandwidth to tackle special projects that move the business forward, like research into tax implications or partnering on a redesign of the sales commissions structure.

At this stage, the team is starting to be seen as true strategic partners to the business.

How to Progress Beyond the Automated Stage

The close is in good shape by this point and investments in documentation and automation are paying off with accurate, timely, and audit-ready financials. Progressing to the next stage requires focusing in two areas: pre-close workflows and relationships outside of the finance team.

Again, using the starting point of your month-end checklist, begin by identifying where an ongoing check would reduce time spent during month-end. For teams on Numeric, this typically involves putting in place their first set of transaction monitors to catch items like transactions without a vendor or where JEs were booked to specific accounts. The focus is largely on flagging transactions that may be anomalies in real-time.

On the relationships front, a proactive close involves a high amount of collaboration with teams outside of finance to provide the business with actionable insights. Invest in understanding what insights from financial data would enable better decision-making, who on the team is the best point of contact to deliver those insights to, and the cadence of reporting needed for that specific department.

Stage 4: Proactive

The final stage of close maturity is documented, automated, and increasingly proactive with the bulk of the traditional “month-end” close being completed in real-time.

The close is also proactive in the level of integration with the business — every close relays clear insights into what is happening with the business, department-level analytics to drive decision-making, and conversations with core stakeholders that translate financial data into improved operations.

Ultimately, at this phase the significance of “month-end” reporting actually begins to decline – at nearly all times the accounting team is able to pull meaningful reporting and provide a snapshot of the business’ health. The month-end close exists to drive a higher level of accuracy and proper controls, but financial data is actionable at nearly every moment.

Core Characteristics of the Proactive Stage

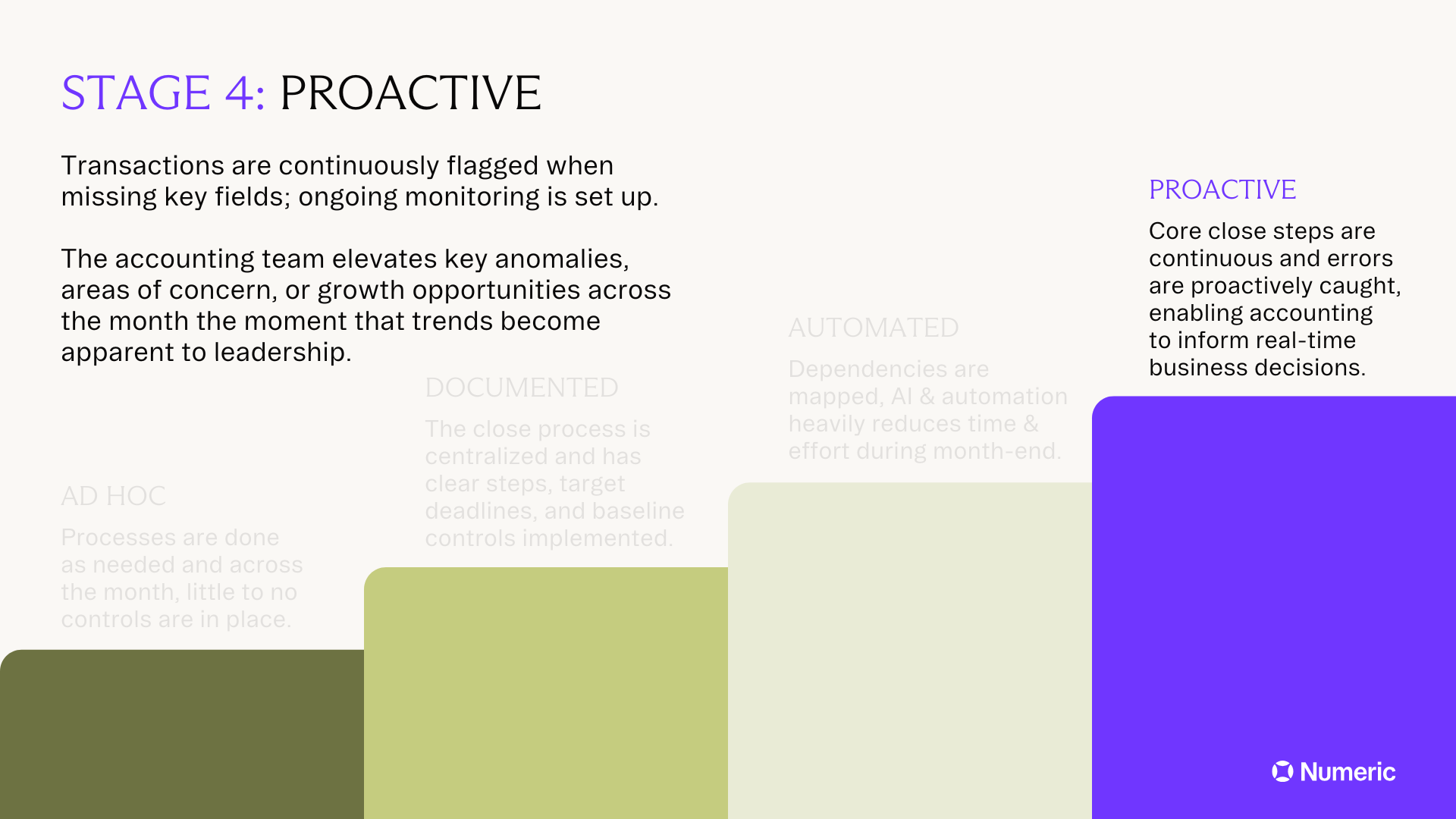

- Transactions are continuously and automatically flagged when missing key fields, like vendor, or when tagged to the wrong account using ongoing monitoring

- The accounting team elevates key anomalies, areas of concern, or growth opportunities across the month the moment that trends become apparent to the leadership team

- Beyond a month-end package, the accounting team is committed to deliverables and reporting that align largely with when those insights are most helpful for the business — at nearly all times the team could run a P&L with an actionable level of accuracy

- FP&A and accounting workflows are intertwined, with a month-end process that is “modular”, core accounts are passed over to FP&A first to enable timely analysis

- Reporting at month-end includes practical insights on what was learned about the business

Key Value Provided at the Proactive Stage

At this stage, the value of the accounting team is clear — the team acts as strategic advisors to the business, informing decision-making with strong financial data.

The accounting team is integrated into the business, playing a role in navigating conversations on finance implications for acquisitions, new product rollouts or pricing models, or shifts in compensation structure. With stronger real-time financial data, the business is now able to make mid-month pivots (ex. Advising to up marketing campaign spend after analyzing revenue performance), without the delay of month-end reporting.

At this stage with far less time spent on manual closing activities and more work shifted across the month, the lines are blurred between the FP&A and accounting teams, with the entire department focused on explaining the “why” and implications of financial data.

The accounting team consistently has time to benchmark performance, ask for vendor discounts, and tackle technical accounting or tax projects with material impact.

How to Use The Month-End Close Maturity Model

In producing the month-end maturity model, our goal is to provide accounting teams with shared language and a framework to drive continuous improvements in their month-end close.

For Controllers or CFOs, use the model as a lens to pinpoint where your team stands and chart the path to a stronger month-end close.

- Leverage the framework when starting a new position to quickly gauge month-end maturity and inform your first 30-60-90 plan as a new Controller.

- Share the model with your team — is the entirety of the accounting team aligned on your current stage?

- Use the model as a reflection tool to inform quarterly or annual goal setting and planning:

- What would need to change for you to confidently claim that your team had advanced to the next stage?

- What areas of the close are perhaps behind the sophistication of other steps? Ex. AP is well organized and automated where possible, but flux analysis consistently takes 4+ days

- What are concrete steps that if taken inch your team closer to a more mature close process?

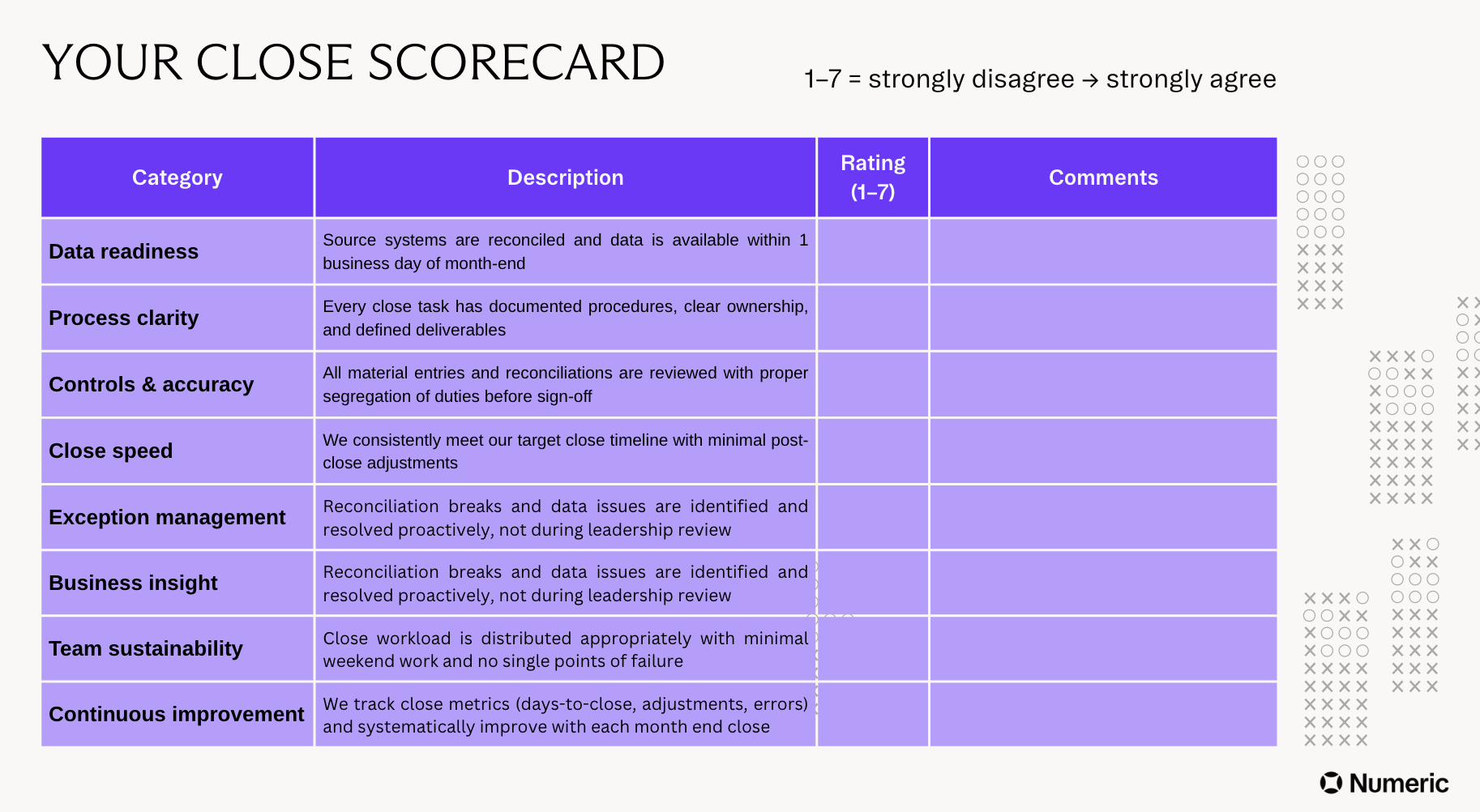

Additional: The Close Maturity Scorecard

For the most thorough evaluation of your close process, consider layering the maturity model with our financial close scorecard.

This scorecard provides evaluation criteria for eight distinct categories, all of which we formed after speaking with accounting teams about their internal close KPIs. They are as follows:

- Data readiness

- Process clarity

- Controls & accuracy

- Close speed

- Exception management

- Business insight

- Team sustainability

- Continuous improvement

To use the template, score your team’s performance for each category using a 1-7 Likert scale where 1 = Strongly disagree; 2 = somewhat disagree; 3 = slightly disagree; 4 = neutral, and so on and so forth.

By measuring progress via the scorecard, it’s easier to assess if your team seems to be moving up in the month-end close maturity model as well.

The Month-End Boost: How Numeric Can Help

Numeric works with accounting teams across the close maturity model to implement well-documented, automated, and proactive month-end processes with close automation software.

For teams looking to take their close maturity from “Ad Hoc” to “Documented”

Get started with Numeric’s close checklist, a project management tool purpose-built for accounting teams. There, you can organize your month-end close process, map out dependencies, and provide full visibility on the status of your close.

With Numeric’s AI Insights, you can also generate exec-ready reports of close performance to-date and see which tasks are moving slower than usual versus prior periods.

For teams looking to take their close maturity from “Documented” to “Automated”

Numeric enables teams to automate reconciliations, leverage AI for flux analysis, and reduce the manual work involved in their month-end close.

Cash reconciliations, one of the most tedious workflows in accounting, can be automated by 90+% using Numeric’s Cash Management tool. Teams like Brex rely on Numeric’s cash tooling to automate JE posting, match 90+% of their cash accounts, and sync up to each of their hundreds of bank accounts.

For teams looking to take their close maturity from “Automated” to “Proactive”

Numeric empowers accounting teams with real-time transaction monitoring to flag anomalies and ensure compliance with accounting policies. With flexible reporting and search tools, teams use Numeric to quickly elevate insights to the business and integrate more closely with the FP&A function.

Interested in exploring how to uplevel the maturity of your close process? Schedule a conversation with our team.

.png)

.png)

.png)