Blackline Review: Is Blackline Worth It?

.png)

Accounting teams are always on the hunt for better tools, stronger processes, and easier ways to close fast with accuracy. One of the core bottlenecks for accounting teams in handling growing business complexity is account reconciliation and managing month-end. As entities and transactions mount, it becomes even more challenging to wade through an every-growing number tasks.

Enter BlackLine, which promises to streamline the close, reducing errors and inefficiency. But is it really worth it?

In this BlackLine review, we’ll take a look at what BlackLine is, what features it offers, what plans are available, what the average cost is, and what the implementation process looks like. We’ll also go through online BlackLine reviews to see what existing customers highlight as the main pros and cons of the platform. Finally, we’ll propose the top 3 BlackLine alternatives for teams with different needs and budgets.

While evaluating BlackLine, consider Numeric as an option to get started improving month-end fast - and without implementation hurdles.

Built to scale with your team, Numeric is an AI-powered version of close management, easy to set up and easier to configure to your business’ changing needs. Schedule a personalized demo to learn how Numeric can help your team add structure, automate month-end close, and boost efficiency.

What Blackline Is

BlackLine is a cloud-based software platform designed to automate and streamline financial and accounting processes for organizations. It's aimed at enhancing the efficiency, accuracy, and effectiveness of these processes, which includes tasks like financial close management, account reconciliations, intercompany accounting, and other related activities.

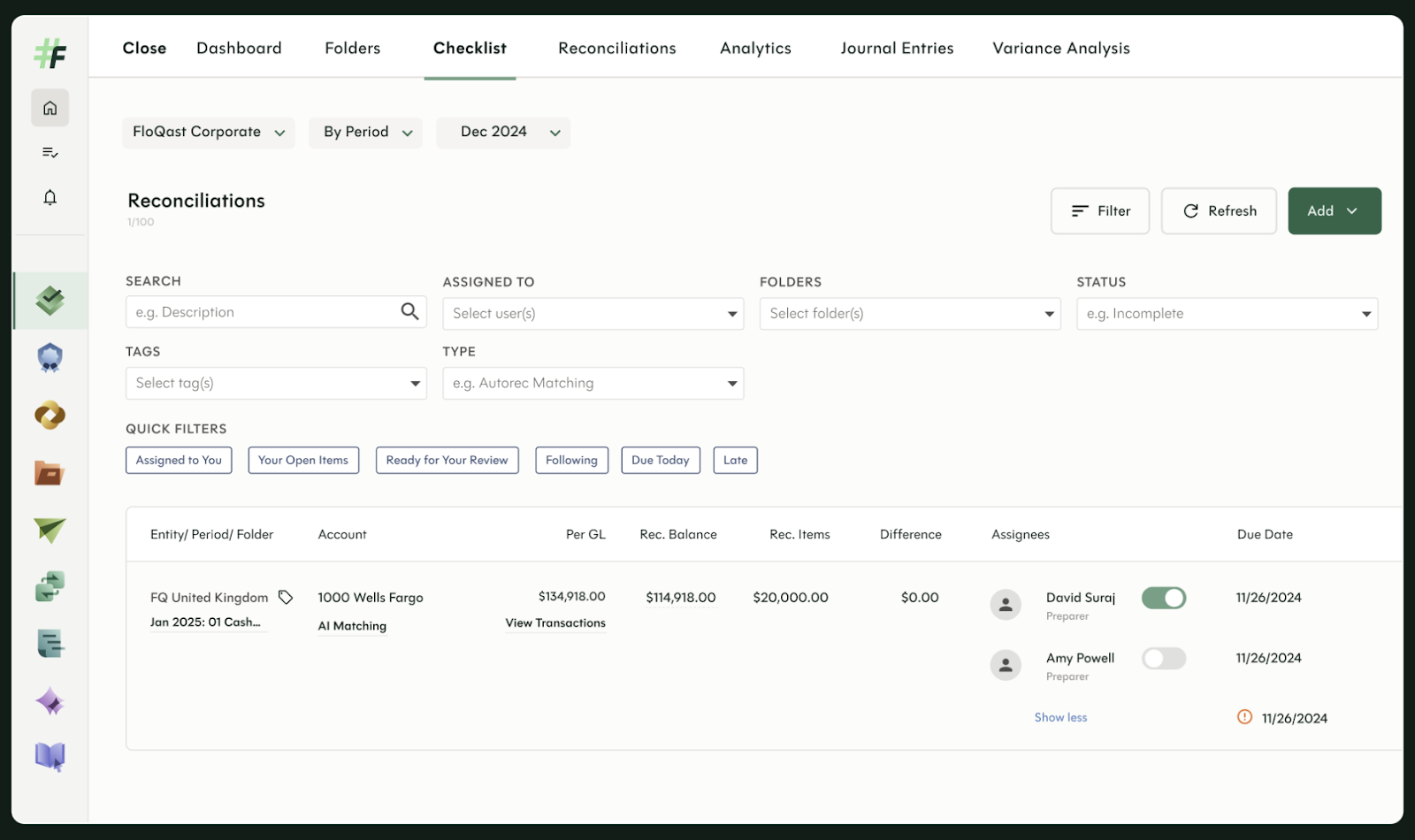

Here are the key features of BlackLine:

- Account Reconciliation: BlackLine account reconciliation is a main feature that automates the reconciliation of accounts by comparing data from different sources, identifying discrepancies, and highlighting areas that need attention. This assists in ensuring that financial statements are accurate and complete.

- Financial Close Management: BlackLine organizes and streamlines the financial close process, enabling teams to complete close in a timely and accurate manner.

- Intercompany Accounting: BlackLine facilitates the management of intercompany transactions by automating reconciliations and providing a platform for intercompany collaboration. This is crucial for organizations with multiple subsidiaries or divisions.

- Compliance and Controls: BlackLine incorporates built-in controls and compliance tools to ensure that financial processes adhere to required standards and regulations.

- Integrations: The platform can integrate with other financial systems and ERP (Enterprise Resource Planning) solutions, allowing for a seamless flow of financial data and procedures and making it a versatile tool for managing financial processes.

BlackLine is suitable primarily for large enterprises, looking to improve their financial and accounting processes, ensure compliance, and achieve a more efficient financial close.

How BlackLine Works

BlackLine operates as a cloud-based platform that centralizes, automates, and streamlines financial and accounting processes. Here's an overview of how BlackLine works:

- Centralization: BlackLine centralizes financial data and processes, making it easier for teams to access and manage financial information from a single platform.

- Automation: As an accounting automation software, the platform automates routine and repetitive tasks such as account reconciliations, transaction matching, and journal entry postings, which helps in reducing manual errors and saving time.

- Real-Time Visibility: The app provides real-time visibility into financial processes and data. This enables timely monitoring and analysis, facilitating better decision-making and compliance checking.

- Reporting and Analytics: The platform offers reporting and analytics tools that provide insights into financial performance, helping in identifying areas for improvement.

- User Access and Collaboration: BlackLine enables collaborative work by providing controlled access to financial data and processes to relevant team members, promoting cooperation and efficiency.

- Cloud-Based Platform: Being a cloud-based solution, BlackLine allows for accessibility from anywhere, which is beneficial for distributed teams and remote work environments.

By amalgamating these features and functionalities, BlackLine empowers organizations to improve the efficiency, accuracy, and compliance of their financial and accounting processes, ultimately contributing to a more effective and streamlined financial management.

Compare BlackLine with Numeric's reconciliation product

Getting Started with BlackLine

BlackLine is often known for being powerful, but also requiring thoughtful implementation either accomplished by an in-house expert or by partnering with consultants. Getting started with BlackLine to streamline your financial and accounting processes requires a systematic approach.

Here are the necessary steps to implement BlackLine:

- Research and Contact BlackLine: Look into BlackLine's offerings through their website or contact them directly for detailed information on how their platform can meet your organization’s needs.

- Request a Demo: Ask for a demo of BlackLine's platform and other financial close software tools to understand its capabilities, how it can be used to automate your financial processes, and how it compares to similar platforms.

- Evaluate Pricing and Implementation Timeline: Obtain pricing information and understand the terms of use to ensure it aligns with your budget and operational expectations. Ask about the implementation timeline and what’s required from your team to get started.

- Engage Stakeholders: Involve key stakeholders from your organization to gather input on requirements and ensure buy-in for adopting BlackLine.

- Choose a Suitable Plan: Select the BlackLine plan that meets your organization's needs based on the features offered.

- Implement: Work with BlackLine or a certified implementation partner to set up the platform, including integrating it with your existing systems.

- Get Training: Enroll your team in the training programs offered by BlackLine to ensure relevant team members are well-equipped to use the platform effectively.

- Migrate Data: Migrate necessary financial data to BlackLine under the guidance of BlackLine support or an implementation partner.

- Configure and Customize: Configure BlackLine to meet your specific financial process requirements and customize it as necessary. Depending on your organization’s size and scale, this may require involving consultants or team members familiar with BlackLine’s software.

- Go Live: Once satisfied with the setup, commence using BlackLine for your reconciliation and financial close processes.

- Receive Ongoing Support and Evaluation: Leverage BlackLine's customer support for any issues, and continuously evaluate the platform’s effectiveness in meeting your financial needs.

By following these steps, you'll be better prepared to launch BlackLine successfully and make the most out of its complex features to enhance your accounting processes.

BlackLine Pros and Cons

When deciding if this is the right platform for your team, it’s a good idea to look at the advantages and disadvantages that are highlighted in BlackLine reviews. A well-informed decision should consider the balance between the pros and the cons.

BlackLine Pros

The most important benefits of the app include:

- Strong, potent accounting automation platform

- All-inclusive account reconciliation features

- Sophisticated transaction matching

- Comprehensive audit trails and controls

- High reliability and uptime

- Seamless integrations with leading financial and business management tools

- Good fit for large-scale enterprises

BlackLine Cons

Meanwhile, the most considerable drawbacks to keep in mind are:

- Overly complex implementation and setup

- Steep learning curve, leading to adoption challenges

- Occasional performance lag

- High implementation and recurring costs

- Need to have a dedicated admin to tap into all features for a positive ROI

- Poor fit for small teams and organizations

BlackLine Plans and Costs

The BlackLine pricing structure and plans are not listed on the company website. The cost can vary significantly depending on various factors including the size of the organization, the number of users, and the specific needs and features required. Compared to Numeric or FloQast, the two BlackLine alternatives, pricing tends to be steeper due to implementation and consultation costs.

Each team’s needs and circumstances are unique, so it's advisable to contact BlackLine directly to get an accurate pricing estimate tailored to your specific needs.

Blackline Terms and Contracts

The specifics regarding the terms and contracts of BlackLine's services are not publicly disclosed on their website, however, there are several steps you can take to obtain this information:

- Contact BlackLine Directly: Reach out to BlackLine via their website or phone to inquire about their terms of service and contract options.

- Request a Sales Consultation: Schedule a consultation with a BlackLine sales representative who can provide detailed information on the terms and conditions, as well as contract options.

- Legal Consultation: Consider consulting with a legal advisor to review and understand the terms and contracts proposed by BlackLine, especially if there are complex clauses or commitments.

- Industry Forums and Reviews: Look for discussions or reviews on industry forums or review sites where other BlackLine customers might share their experiences regarding the terms and contracts.

- Peer Interaction: If possible, interact with peers or other organizations that have used BlackLine to get their insights on the terms and contracts.

- Custom Contract Negotiation: Discuss with BlackLine or your legal advisor if there's a possibility to negotiate custom contract terms that better suit your organization's needs.

It's crucial to have a clear understanding of the terms and contracts, including the commitments, obligations, and any other legal implications before engaging with BlackLine or any other service provider.

Blackline Reviews and Testimonials

One of the best ways to decide if a software tool like BlackLine is the right choice for your team is to check out customer reviews on reliable websites.

You can find BlackLine reviews by existing customers on:

- G2: Average rating of 4.5/5 based on 985 reviews

- Gartner: Average rating of 4.5/5 based on 526 reviews

- TrustRadius: Average rating of 8.6/10 based on 370 reviews

- Capterra: Average rating of 4.3/5 based on 19 reviews

In their positive reviews of BlackLine, customers most frequently highlight the following features and benefits:

Automation That Boosts Efficiency

Ajay K. shares says this on G2:

“What I like most about BlackLine Financial Close Management is how it automates many of the tasks that typically take a lot of time, like reconciling accounts and closing books. This makes the whole process faster and less prone to errors.”

Similarly, a verified user shares the following on TrustRadius:

“The capabilities in BlackLine enable the end user to automate reconciliations and ensure low miss rate in achieving complete reconciliations and provides commentaries section to capture the history of records that improves transparency and effectiveness.”

Easy Reconciliations

Here is what a BlackLine customer wrote on Gartner:

“Blackline is a massive upgrade from our old reconciliation software - it allows us to better automate reconciliations and gain efficiencies, effectively freeing up more time for our employees.”

A verified user discusses the reconciliation capabilities in their review on TrustRadius:

“BlackLine alleviates having to do the reconciliations manually and allows us to deal with only the outliers that are not automatically matched by the software.”

Meanwhile, customers also wrote some negative reviews of BlackLine where they focus on the main weaknesses of the platform, including:

Missing Tools and Features

This is what Anne K. wrote in her review of BlackLine on Capterra:

“BlackLine misses out on so many features, the "to-do list" needed improvements and compared to other software in the Accounting field, BlackLine has few features.”

Another verified reviewer shared a similar sentiment on the same website:

“The software is limited to reconciliations and intercompany transactions wherein the vast majority of software are investing on in-memory capacity and cloud for more flexible transactions.”

Limited Customization and Flexibility

Marco C. left the following review of BlackLine on G2:

“The system provides limited choices when it comes to customizing its features. I want to modify dashboard elements to suit our exact requirements better.”

Frances M. highlighted the same issue on G2:

“I wish the dashboards were customizable. I also think that there is a lot of adimnistrative time to mark things as complete/upload supporting items/etc. I wish there were less clicks required to do things.”

Steep Learning Curve and Overwhelming Onboarding

A verified user of BlackLine wrote this on G2:

“very steep learning curve, poor support from implementation partners and BL's implementation consultants who have half-baked knowledge on the BL products, therefore ease of implementation is questionable. Post implementation customer support needs major uplift.

The product's features are not intuitive and the way BL is designed is that it does not show the users the issues when working in it, making it 'ease to use' a bit cumbersome.”

A verified user added the following on TrustRadius:

“Hard learning curve for companies that do not have financial systems dedicated people, and for teams that like to manage accounting schedules in Excel.”

Cumbersome UI That Is Difficult to Use

Kelsi N. commented this in her BlackLine review on Capterra:

“This is the clunkiest software I've ever used. It's not really intuitive and seems like it's dated back from the 90s. It does the job, but I feel like they should really focus on their user interface.”

Similarly, another verified user wrote the following on G2:

“The product's features are not intuitive and the way BL is designed is that it does not show the users the issues when working in it, making it 'ease to use' a bit cumbersome.”

In sum, many BlackLine reviews and testimonials highlight the automation capabilities, the efficiency the platform brings to financial processes, and the helpful customer support.

However, a large number of customers find the software challenging to navigate and reference onboarding hurdles as well as relatively restricted customizations and missing functionalities which is not expected from a platform as complex and as expensive as BlackLine.

Best Fit Use Cases for BlackLine

A detailed BlackLine review reveals that the platform is a powerful solution that is best suited for large organizations, typically Fortune 2000 companies, with complex financial needs that require enterprise-grade automation, compliance, and control.

Typically, BlackLine brings the most value under the following scenarios:

- Multi-Entity, Global Consolidation on Enterprise ERPs like SAP, Oracle Fusion, or Workday: Perfect for companies with complex ownership structures, international subsidiaries, and multi-currency operations.

- Heavy Volume Transaction Matching: Good where high-volume reconciliations across bank statements, intercompany transactions, and subledger accounts are required — and an in-house admin can configure rules appropriately as the business changes.

- ERP-Diverse Environments: Suitable for enterprises that work across multiple ERP systems as BlackLine adds a centralized automation and reporting layer.

- Mature Finance Teams with Dedicated IT Resources: Great for companies that can commit to a multi-month implementation and hold the capacity for ongoing configuration and management.

All in all, BlackLine could be the right choice for Fortune 2000 companies and organizations with complicated accounting processes and needs in addition to adequate financial and human resources. It is not a good option for smaller teams, mid-market companies, or those with limited resources.

Blackline Competitors and Alternatives

If after a careful BlackLine review, you conclude that this is not the best option for your team, you can turn to one of BlackLine's competitors.

The top BlackLine alternatives in the accounting automation software space are:

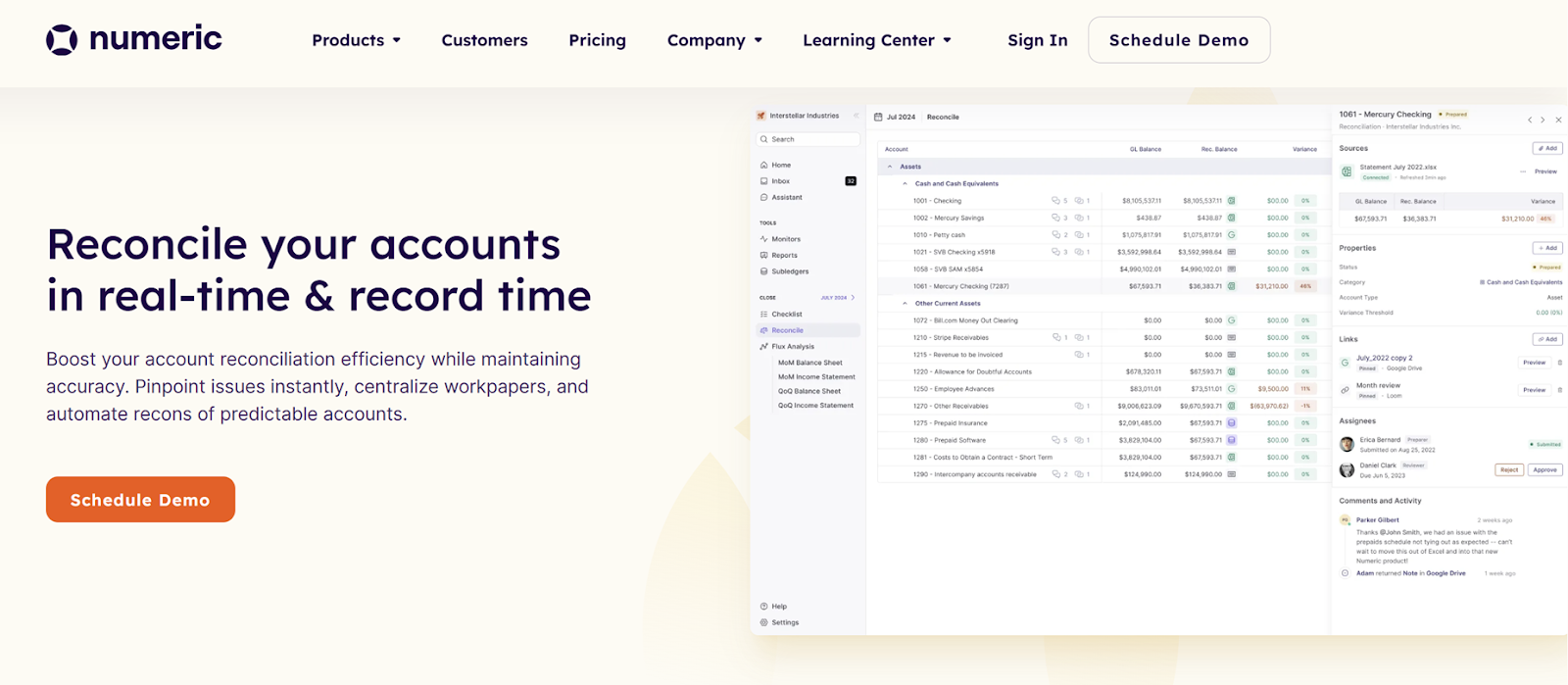

Numeric: Numeric supercharges the month-end close by offering robust flux analysis, reporting, task management purpose-built for accountants, and lightning-fast reconciliations primarily for teams on NetSuite. As the AI native close management tool on the market, with Numeric teams can set-up ongoing transaction monitoring, write first-draft flux explanations leveraging AI, and drill down to specific vendors or transactions without leaving the product.

For teams that want the power of a tool like BlackLine, but a simpler implementation — Numeric stands out as an option to consider.

FloQast: FloQast is a close management software which helps accounting teams close books faster and more accurately. Compared to BlackLine, FloQast is a better fit for mid-market teams that need basic financial automation capabilities, collaboration, and team accountability. FloQast is often the tool of choice for teams on Microsoft Dynamics and Microsoft Great Plains.

Adra by Trintech: Adra, a part of Trintech, offers a suite of solutions including Adra Matcher, which is a reconciliation software aimed at streamlining the reconciliation process and improving accuracy. Compared to BlackLine, Adra by Trintech can provide a more streamlined, modular approach tailored to mid-sized companies looking to automate financial close without implementing a full-suite system.

Why Teams Are Choosing Numeric

While BlackLine and its competitors each offer valuable features and unique capabilities, Numeric stands out as the top option for teams that want powerful automation without the overhead and overcomplexity. Built for speed, visibility, and ease of use, Numeric helps accounting teams close faster, collaborate better, and stay audit-ready. All this without the need for months of setup and heavy IT support.

Designed specifically for modern, mid-sized companies ready to scale on NetSuite, Numeric delivers enterprise-grade value in a flexible, intuitive, affordable package. This is achieved via AI-empowered workflows and drill down and pivot capabiilities across the product to the specific transaction in question.

Bottom Line

Navigating the intricate maze of today's financial environment demands cutting-edge tools that not only simplify processes but also ensure accuracy and compliance. Our BlackLine review shows that the app could be a good option for large enterprises which are looking for comprehensive automation but which also have a dedicated admin and significant budget. For smaller teams, BlackLine usually proves overpowering rather than empowering.

Meanwhile, Numeric offers an intuitive, user-friendly, efficient, and affordable alternative that works great for both mid- and large-sized companies on NetSuite. With the power of AI, Numeric helps you manage complexity, close faster, and stay audit-ready. Schedule a personalized demo to learn more.

FAQs

Is BlackLine Good for Small Businesses?

No, BlackLine is usually not a good fit for small businesses. The complex features, the time-consuming implementation, and the high cost are an overkill. Smaller firms typically find simpler platforms, such as Numeric and FloQast, to be more effective.

Does BlackLine Integrate with NetSuite, SAP, or Oracle?

Yes, BlackLine offers seamless, pre-configured integrations with NetSuite, SAP, and Oracle as well as with other ERP systems.

Is BlackLine Cloud-Based or On-Premise?

BlackLine is a fully cloud-based, SaaS platform which enables real-time data sharing and cooperation among team members.

Can BlackLine Handle Multi-Entity Consolidations?

Yes, BlackLine has a built-in Consolidation module that is specifically designed for multi-entity environments.

What ERP Systems Does BlackLine Integrate With?

A BlackLine review reveals that the software integrates with NetSuite, SAP, Oracle, Microsoft Dynamics, Sage Intacct, QuickBooks Online, and other popular ERP systems.

.png)